Reliance Retail not as profitable as Future Retail, yet

Investors would be more interested in profit margin than in revenue growth

Shishir Asthana Mumbai That Reliance Industries’ retail business – Reliance Retail - has come of age can be judged from the fact that the company for the first time in its analyst presentation divulged details about this business. For the year ended March 2013, RIL announced that its retail business revenues crossed the Rs 10,000-crore mark. Further, the division has managed to post a moderate profit at the operating level.

Reliance Retail saw a sales growth of 42% in FY13 from Rs 7,599 crore to Rs 10,800 crore, but importantly earnings before depreciation, interest and tax swung from a loss of Rs 342 crore to a profit of Rs 78 crore. Though Reliance Retail may be catching up with Future Retail (erstwhile Pantaloon Retail) in terms of sales, it has a long way to go when we look at both companies’ profitability.

On a consolidated basis Future Retail reached a turnover of Rs 7,900 crore in FY09, but unlike Reliance Retail it posted an operating profit of Rs 615 crore. When the company touched revenues of Rs 9,769 crore in FY10, its operating profit improved to Rs 966 crore. Reliance, on the other hand, has barely turned positive at the operating level on reacing the Rs 10,000-crore sales mark.

The reason for the lower profitability of RIL’s retail business is its sales mix. As per the details in Reliance’s analyst presentation, Value Format stores accounted for 56% of Reliance Retail’s revenues coming from 760 stores (nearly 50% of its store strength). Reliance’s value format stores are now the largest grocery retailer in the country and have posted the highest growth rate of 18% within its various categories. Importantly, growth in this category came from same-store (like-for-like) sales and not new store additions.

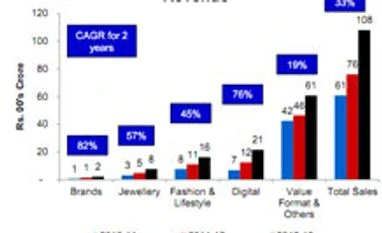

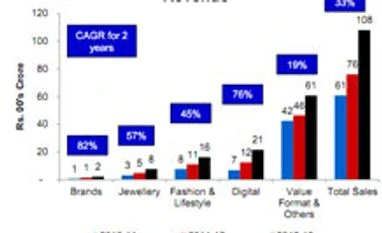

On a two-year CAGR basis value format stores have grown by 19%. Low shelf-life of products adds to the logistics cost thus impacting margins. The company seems to be consciously reducing its dependence on this division if one were to look at new store additions data. Reliance has added the maximum numbers of stores at 95 in FY13 in fashion and life style division, 46 new stores were added in the digital division while value format stores saw only 10 new stores. For Future Retail, the fashion and lifestyle segment was the category contributing most to its profitability.

The fastest growth on a two-year basis has been from the digital segment of 76% a year, which now accounts for 20% of revenues with only 139 stores. On a like-for-like basis the division has seen a robust 17% sales growth. The fashion and lifestyle division saw a 45% growth a year over the last two years, with like-for-like growth being only 8%.

An important distinction worth noting is that Reliance has clocked a turnover of Rs 10,000 crore with only 9 mn sq ft of retail space, while Future Retail in FY11 had touched a revenue of Rs 11,000 crore with a retail space of 13.4 mn sq ft.

Reliance’s retail business is expected to be a major growth driver can be seen from the fact that the company management is expecting sales of around Rs 40,000 crore over the next three years. However, as far as the market is concerned it is the profit margin that will drive the share price and not revenue growth.

)

)