Resurgent edu-tech may make a comeback in VC portfolios

Patanjali Pahwa Mumbai Advitiya Sharma, founder and former board member of Housing.com, had just quit his start-up. He decided he needed a break after Housing.com and enrolled himself in Vipassana in Igatpuri, a few hours from Mumbai. Deep in meditation on the fourth day, he accessed his memories with his grandfather who used to be a teacher.

Sharma, knew at the time, his next start-up had to be around education. He started Genius Schools, a programme to make teachers the entrepreneurs, source free content and use artificial intelligence to map the student's interest and learning levels. "I refused funding. I was approached by several reputed companies. Once we have the numbers, I'll take one of them on their offer," said Sharma.

While Sharma's inspiration was his grandfather, in the past four months, around 15 start-ups have found funding among venture capitalists (VCs), both foreign and Indian. The VCs haven't been privy to divine intervention. They see a market valued at $50 billion and waiting to be tapped.

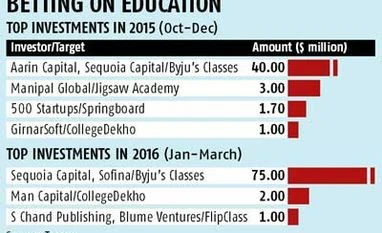

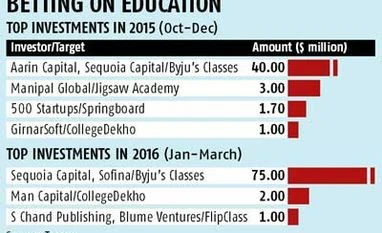

According to Tracxn, investments from January to March were close to $100 million, with Byju's Classes capital infusion by Sequoia Capital, a few weeks ago, contributing to the bulk of it. But, the number of cheques given, be it angel or seed, has also increased compared to the previous quarter. From October to December, there were only 12 investments with investments under $50 million. Last year, there had been some reluctance to invest in education-technology (edu-tech) companies, with several VCs questioning the unit economics.

"In India, there are three types of spend in education: learning, testing and books. In my estimation, 95 per cent of the spend is on learning, one per cent on testing and four per cent on books," said Ajeet Khurana, angel investor.

According to him, most edu-tech start-ups focus on testing. "But testing is usually given free at coaching classes and for people to shop for mock tests is difficult."

Khurana, who has investments in around 30 companies, said that even those who opted for it wanted it at a small cost. The ticket-size here is small in the low thousands, and not too many customers, which makes it difficult for companies to play on volume. "The other is on books. But, in India, the majority of the population still prefers physical books," he said.

Adding: "Most start-ups offer video learning. Let's look at human psychology here. Students don't like studying. If you sit them in front of a video, they won't pay attention even if it is the best of the teachers; they prefer a teacher physically in front of them, asking them to pay attention."

This might have led to funding drying up.

)

)