Japanese investor SoftBank has written off around $475 million (Rs 3,226 crore) in the value of its combined shareholding in Ola and Snapdeal, its two largest investments in the country, in the nine months till December 31. It reported a loss of 39,281 million yen in the value of the company’s investments, primarily in India, on Wednesday. The loss reported was despite foreign exchange gains of 16,133 million yen. “Gain or loss arising from financial instruments at FVTPL (fair value through profit or loss) comprises mainly changes in the fair value of preferred stock investment including embedded derivatives, such as ANI Technologies and Jasper Infotech in India, designated as financial assets at FVTPL,” it said.

SoftBank had led a $210-million investment in Ola and put in $627 million in Snapdeal in October 2014. It had also made follow-on investments in both firms. The news of markdowns in the value of Ola and Snapdeal comes at a time when both companies are in talks with investors to raise fresh funds to take on deep-pocketed competition.

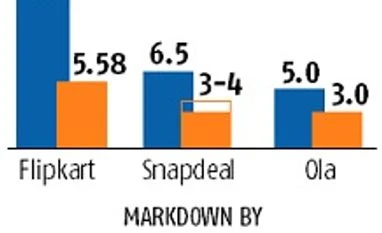

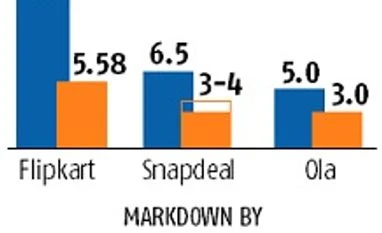

Snapdeal is said to be in talks with SoftBank to raise fresh funds at a valuation between $3-4 billion, down from its peak valuation of $6.5 billion. Similarly, Ola is on the market to raise fresh funds at a valuation of $3 billion, down from a peak valuation of $5 billion.

In November, SoftBank had reported a loss of 58,140 million yen through depreciation in value of its shareholding in Ola and Snapdeal for the six months that ended September. Of that figure, 29,622 million yen was contributed because of the fluctuation in yen.

Removing the changes in the value of SoftBank’s shareholding because of losses or gains from currency fluctuation, the investor marked down the value of its combined shares in Ola and Snapdeal by 26,896 million yen ($230 million) in the three months ended December 31.

Despite the eroding value of its two largest investments in the country, SoftBank Chairman Masayoshi Son continues to be bullish on investing here. In December, Son said SoftBank would surpass its $10-billion commitment in the country, having already invested $2 billion here.

“The 21st century belongs to India, since the demographics are on its side when it comes to being a superpower,” Son said last year. “There are over 800 million young people in the country, who are smart.”

)

)