Tata Power on Monday reported a two-fold rise in net profit for the June-ended quarter, with a push from better performance in the coal mining and renewables segment.

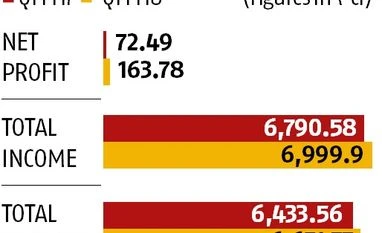

Net profit was Rs 163.8 crore, from Rs 72.5 crore in the same period a year before. “Mainly due,” it said, “to strong performance of the Indonesian coal mines, the renewable business and sustained operations at other Indian companies like Maithon Power, Tata Power Solar, Tata Power Delhi Distribution, Powerlinks and others.”

However, it failed to meet Street expectations by a huge margin. In a Bloomberg poll, five analysts had estimated the net profit at Rs 397 crore and revenue at Rs 7,286 crore.

“The expectation was higher over an inter-company dividend payment mismatch, which may not be exact on a quarterly basis. Overall, the numbers are good and we expect it to improve further if the company manages to improve Mundra (in Kutch) coal procurement,” said an analyst with a domestic brokerage, who did not wish to be identified.

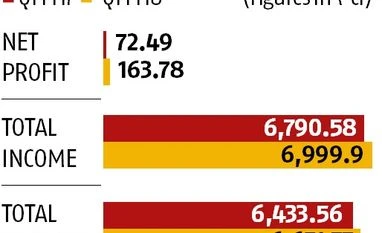

Total income grew three per cent to Rs 7,000 crore, from Rs 6,791 crore a year before. Expenses grew three per cent to Rs 6,652 crore.

The power business reported a three per cent rise in revenue to Rs 63,442 crore. Earnings before interest, tax, depreciation and amortisation were Rs 2,514 crore, a rise of 40 per cent at the consolidated level. Consolidated profit for the renewables portfolio for the June quarter was Rs 109 crore, which does not include the investment in Welspun Renewables Energy, according to Tata Power’s results presentation.

In its power distribution business, it reported a dip in regulated assets to Rs 5,594 crore, from Rs 6,490 crore a year before.

Coastal Gujarat Power (CGPL), subsidiary for Tata Power’s Mundra plant, reported an operating loss of Rs 431 crore, from one of Rs 383 crore in the same period a year before. The company statement added it was in discussion with the state governments concerned and options, including a 51 per cent stake sale in the plant, was at an exploratory stage.

“Incremental losses in CGPL due to coal price increases largely offset by gains in coal and logistics businesses,” it stated. The coal business reported a gross profit of Rs 22.8 crore, more than double the Rs 8.1 crore a year before.

As of June, consolidated debt was Rs 48,619 crore and the debt to equity ratio was 3.1.

)

)