Two-wheelers make more money than four-wheelers

In FY15, operating margins of two-wheeler makers were nearly twice those of top passenger car and SUV makers

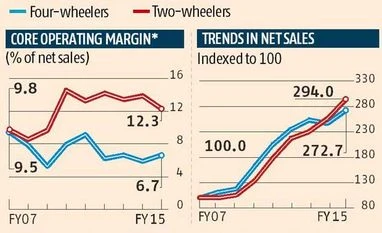

Krishna Kant Mumbai They are small and less glamorous than sports utility vehicles (SUV) and passenger cars but two-wheelers make more money for their makers than four-wheelers. Last financial year, the operating margins of two-wheeler makers in India were nearly twice that of the average margins of top passenger car and SUV makers.

Margins in the two-wheeler industry have consistently been higher than those in the four-wheeler industry for all of the past decade, thanks to a good showing by top two-wheeler makers like Hero MotoCorp and Bajaj Auto.

The analysis is based on the audited financial results of unlisted and listed two- and four-wheeler makers. The sample includes six four-wheeler makers - Maruti Suzuki, Tata Motors, Mahindra & Mahindra, Hyundai Motors India, Honda Cars India, Toyota Kirloskar and Ford India. Other multinationals were dropped as their data for 10 years was not available.

Two-wheeler makers in the sample include Hero MotoCorp, Bajaj Auto, TVS Motors, Eicher Motors and Honda Motorcycle & Scooters India. Each company's standalone finances have been considered in this analysis to reflect their domestic automotive business.

Two-wheeler makers' superior profitability reflects in their balance sheets. The industry is almost debt-free and most companies are sitting on free cash. In 2014-15, the five two-wheeler makers had combined debt of Rs 1,082 crore on their books, down nearly 50 per cent over the past five years and equivalent to less than 5 per cent of their net worth.

In comparison, most four-wheeler makers had to raise debt to invest in product development and expansion. At the end of March 2015, the six top four-wheeler makers had debt of Rs 40,300 crore, up nearly 60 per cent in the past year and equivalent to nearly 60 per cent of their net worth.

Maruti Suzuki is an exception and has remained debt-free through the period, and was sitting on Rs 12,600 crore cash at the end of March 2016.

In 2014-15 two-wheeler firms in our sample reported combined revenues and net profit of Rs 81,500 crore, including other income, and Rs 6,900 crore, respectively. In comparison, four-wheeler makers reported combined revenues and net profit of Rs 1.95 lakh crore and Rs 3,440 crore, respectively.

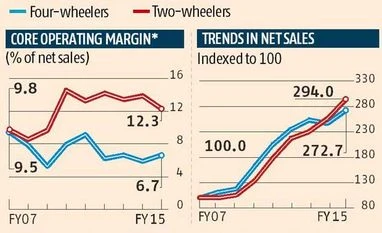

Two-wheeler makers have also grown faster. In the past five years, the combined revenues of the top five two-wheeler firms grew at a compounded annual rate of 17 per cent, outpacing the 11 per cent growth in the combined revenues of the country's top six four-wheeler makers.

"Historically, two-wheeler demand is aligned to consumer demand, while four-wheeler demand is correlated to industrial growth. As the former has been robust in the past six-seven years, two-wheeler makers have done better than other segments of the automotive industry," said G Chokkalingam founder and chief executive officer, Equinomics Research & Advisory.

"It takes far more capital to set up a passenger car business than two-wheeler manufacturing. New product development is also more expensive in the four-wheeler industry than in the two-wheeler industry," says Navin Matta, analyst at HDFC Securities. This affects the profitability and cash flows of passenger car makers.

Four-wheeler companies have together invested around Rs 71,000 crore in capacity expansion and new product development in the past five years. During the same period, two-wheeler makers' capex was around Rs 13,000 crore.

Matta, however, expects the four-wheeler industry to grow faster than two-wheelers in future. "In most markets globally, consumers have shifted to cars and SUVs from two-wheelers, in line with the rise in income. The same is likely to happen in India," he said.

)

)