Vedanta's future plan may trip on past hurdle

Dev Chatterjee Mumbai Anil Agarwal's Vedanta group's plan to buy the Government of India's residual 29 per cent stake in Hindustan Zinc Ltd (HZL) by December will hit a block with the Central Bureau of Investigation's (CBI's) plans to investigate the company's privatisation by the previous government in 2002.

According to media reports, CBI is looking into the entire process at the then NDA government and has asked for information from the mines ministry. The sale, it is charged, was invalid as the company was incorporated under a statute of the Parliament and needed the latter's approval. A similar sale of government-owned oil marketing companies was stayed by the Supreme Court. The HZL stock was down by one per cent to Rs 130 on news that CBI was looking into the matter.

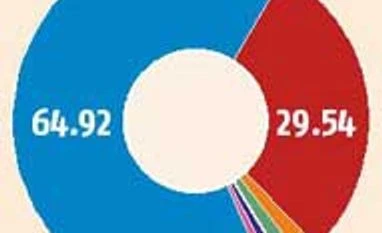

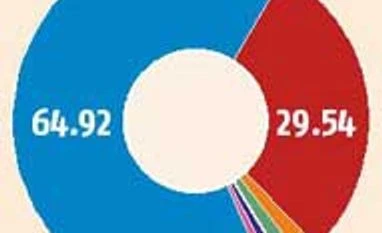

Vedanta, which owns 65 per cent in cash-rich HZL, had recently said it would buy out the rest of the government's stake in HZL and in Bharat Aluminium (Balco) for close to Rs 17,000 crore. A banker had earlier told this newspaper that Vedanta might sweeten its offer by 10 per cent. The company declined to comment on the issue. With a CBI investigation on, the December deadline will be missed, say bankers.

Vedanta's plan after buying the remaining government stake was to merge HZL with its India holding company, Sesa Sterlite Ltd, by early next financial year. This would have helped HZL repay the $3.5-billion of loans it took to acquire Cairn India, due for repayments over the next three years. The takeover of HZL would give Vedanta access to the company's Rs 21,482 crore of cash and investments. This can be used to repay the new combined entity's debt. Under Vedanta's management, HZL has been turned around successfully, making a profit of Rs 6,899 crore in 2012-13 on a total income of Rs 14,732 crore.

In a complex restructuring announced last year, Vedanta merged its two Indian companies, Sesa Goa and Sterlite, into a combined entity called Sesa Sterlite. The new entity - it got approval from the courts in September - holds stake in all of Vedanta's Indian companies, including in Cairn India and HZL. Vedanta has also transferred its entire dollar debt to Sesa Sterlite, taken to buy Cairn India. With this, Sesa Sterlite had net debt of $6.6 bn as on March this year.

Once Sesa Sterlite buys the government share, bankers say its stake will go up to 95 per cent and, by the rules, will either have to bring this down to 75 per cent or go for delisting. A banking source said Sesa Sterlite will go for delisting the company and then merging it with the parent company, after buying out the minority shareholders.

A legal source said in spite of the Attorney General's view that there were no legal problems in the government selling its stake in HZL and Balco to the Vedanta group, it will still need ratification from the Supreme Court, since the latter had stayed a similar earlier sale by the government. If the government sells HZL's stake to Vedanta, then it needs to take Parliament approval.

)

)