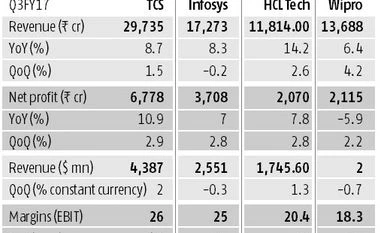

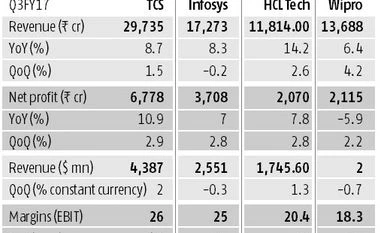

Wipro, the country's third-largest software exporter, lagged peers Tata Consultancy Services, Infosys and HCL in the quarter ended December 2016.

It struggled to grow its business due to uncertainty in the US health care market and rejig in its India and West Asia business. Net profit declined 5.9% to Rs 2,115 crore and revenue grew 6.4% to Rs 13,688 crore. It tried to offset slower revenue growth by cutting costs and improving efficiency.

Operating margin, calculated as sales minus expenses, stood at 18.3% of revenue, a 0.5% point improvement over the previous quarter. Information technology (IT) services revenue decreased 0.7% to $1.9 billion (Rs 12,950 crore), below its October forecast of flat to 0.5% growth.

"Muted performance again; IT services revenue below our estimates," went a note from brokerage Phillip Capital.

Wipro has said it expects to grow between $1.92 bn and $1.94 bn, or one to 2%, in the March quarter. This would see the company's FY17 growth at 4.4-4.7%, less than half of the projected industry growth by Nasscom, apex association of the sector. The latter expects Indian IT to grow by eight and 10% this year.

Wipro had reported a profit of Rs 2,246 crore, on revenue of Rs 12,860 crore, in the same quarter last year.

"In the current year, we believe clarity will emerge and we expect an uptick in the change investments," said Abidali Neemuchwala, chief executive. "We do not expect customer budgets to change drastically. However, we do expect that there could be more momentum in the change spendings."

Neemuchwala, who took over the top job in February 2016, has invested around $1 bn in acquisition — HealthPlan Services for $460 million and Appirio, a US service firm that helps companies implement cloud applications such as Salesforce and Workday for $500 mn.

His first bet on HealthPlan faced a setback with new US President Donald Trump announcing his intention of repealing the Affordable Care Act there — Wipro hopes its platform would be used for transaction processing with that law. It also would add pressure on Neemuchwala to achieve his target of $15 bn with margins of 23% by 2020

"The platform that we have has a couple of capabilities. With or without this uncertainty, we always looked at how can we take that platform to other geographies or other services you can offer it to," said B M Bhanumurthy, operations head.

"Our bold investments in digital, BPaas and cloud applications position Wipro as partner of choice for the digital businesses of our clients. The digital eco-system grew by 9.9% sequentially in the quarter and now constitutes 21.7% of our revenues," said Neemuchwala.

The Bengaluru-based entity said it had signed a deal to buy Brazilian software services firm InfoSERVER for $8.7 mn to get access to the Latin American market.

)

)