ADB, BofA-ML cut FY14 growth forecasts

Point to supply bottlenecks, lagging reforms & inflation pressure; Chidambaram says 6% a near-surety

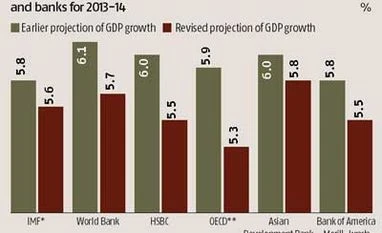

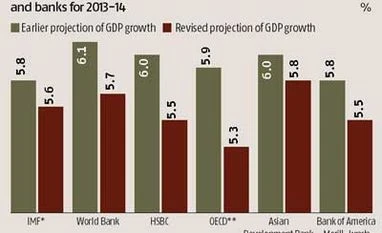

BS Reporter New Delhi Asian Development Bank (ADB) and Bank of America-Merrill Lynch (BofA-ML) on Tuesday scaled down their projections on India’s economic growth for the current year to 5.8 per cent and 5.5 per cent from the earlier estimates of six per cent and 5.8 per cent, respectively.

This came on a day when Finance Minister P Chidambaram exuded confidence about economic growth at six per cent in 2013-14 against the decadal low of five per cent in 2012-13. The minister, though, said six per cent was not satisfactory enough.

ADB, in its Asian Development Outlook 2013 report, said: “Slowing fixed capital formation, weak industrial activity and plodding progress on reform are weighing on the economy.”

This is the second time the Manila-based multilateral lender has cut India's growth forecast for this financial year. In April, it had scaled down the estimate from 6.5 per cent to six per cent.

ADB's report attributed this lowering of forecast to supply-side bottlenecks, “as reflected in the continued slowdown in fixed capital formation, weakness in the industrial sector and sluggish progress in pushing through badly needed structural reforms”.

However, the report offered relief on inflation, as ADB pegged the rate of price rise at an average 6.5 per cent this financial year against the earlier forecast of 7.2 per cent. "India has benefited from a favourable monsoon that pushed down domestic food prices,” it said. The widely-tracked wholesale price index-based inflation averaged a mere 4.77 per cent in the first quarter of 2013-14.

ADB retained its earlier forecast of 6.5 per cent for India’s economic growth during 2014-15, saying the Lok Sabha elections in 2014, along with slower inflation, could give a boost to the economy. “Slower inflation provides some scope for monetary easing that could boost investment and consumption. Growth will be further boosted by pre-election spending, and the pick-up in US growth will support Indian tech companies and related service sectors,” said its report.

BofA-ML says economic recovery in India remains far off. "The worst is over for the Indian economy but recovery remains tepid and shallow, with GDP in the June quarter tracking at five per cent...Friday’s weak CPI (consumer price index) data was a firm reminder of the economic challenges still facing the economy,” said its report Indian banks – recovery weak, delays asset quality cycle. Retail inflation rose 9.87 per cent in June from 9.31 per cent in the previous month.

Finance Minister P Chidambaram said in Jaipur on Tuesday, “This year, by all estimates, it (growth rate) will be six per cent or slightly above. This is not a satisfactory level of growth.”

A week before, the International Monetary Fund had also cut India’s growth forecast, to 5.6 per cent from the earlier projection of 5.8 per cent for 2013-14. IMF, however, takes into account gross domestic product at market prices (inclusive of indirect taxes) and ADB considers GDP at factor cost (exclusive of indirect tax), also taken by the official estimates.

)

)