Corporate India's financial position remains weak

As the RBI report points out, risks to the corporate sector remain due to lower demand

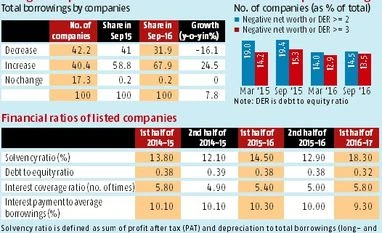

Ishan Bakshi New Delhi India Inc’s financial position continues to be precarious with borrowings of over 40% of non-government, non-financial companies increasing at the end of September 2016 according to the Financial Stability Report (FSR), published by the Reserve Bank of India (RBI).

Though 42% companies did manage to reduce their leverage levels, their reduction in borrowings was not enough to offset the rise in borrowings of others. For the remaining 17% of companies, borrowings stayed at the same level as in September 2015.

Companies in the chemical, computer, food products, hotel, rubber and textiles sectors saw their borrowings decline over the past year, while those in cement, construction, electrical machinery, power, iron & steel, jewellery, mining, automobiles, papers, pharmaceuticals, real estate, telecommunications and transport industries saw a rise.

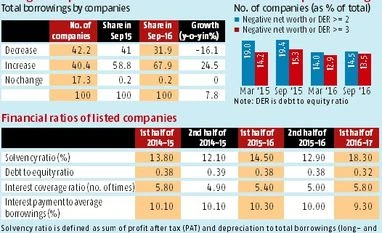

Calculations by RBI show that the proportion of companies with a debt-to-equity ratio of greater than or equal to two, rose to 14.5% at the end of September, up marginally from 14% in March.

But, the silver lining is that it is way lower than 19.4% recorded at the end of September 2015. Further, the share of these companies in total debt has also declined to 16% at the end of September 2016, down from 20.6% in March. It was 30.5% in September last year. A similar trend is observed in the highly leveraged companies whose debt-to-equity ratio exceeds three.

While aggregate debt levels have increased, these companies did show an improvement in their ability to service the interest obligations. Only 14.1% of companies had an interest coverage ratio of less than one at the end of the second quarter in FY17, compared to 15.8% at the end of Q2 last year. A lower interest coverage ratio implies that companies have weak capacity to service their interest burden. Companies in the iron & steel and power sectors continue to have high leverage as well as interest burden.

It is possible that the improvement in the interest coverage ratio reflects in part a rise in profits in the first half of the financial year due to lower commodity prices.

But, it is debatable whether this trend will continue. A report from Kotak Institutional Equities says prices of 65% of the 40 basic raw materials they track are increasing. In some cases, the increase is in double digits. “The risks to margins are being underappreciated,” it says.

The situation could worsen after demonetisation as demand is likely to be hit in the third and fourth quarters of the current financial year. With both top line and bottom line coming under pressure, the ability of highly leveraged corporates to service their interest obligations remains questionable.

As the RBI report points out, risks to the corporate sector remain due to lower demand.

)

)