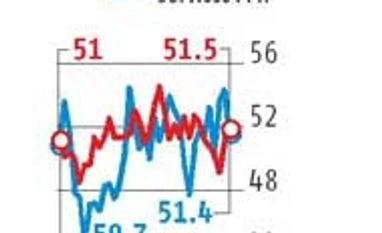

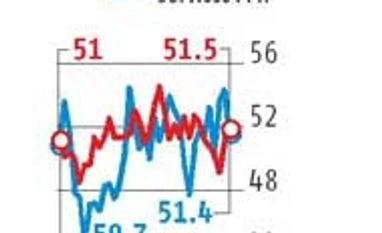

Growth in India’s services firms fell to a three-month low of 51.4 in February from 54.3 in January, as output rose only marginally, a business survey showed on Thursday.

The seasonally adjusted Nikkei/Markit Services Purchasing Managers’ Index (PMI) had experienced a 19-month high rate of growth in January, marking a seventh month above the 50-level that separates growth from contraction.

Read more from our special coverage on "PMI"

Meanwhile, inflationary pressures were subdued, which along with falling growth, fuelled hopes of rate cut by the Reserve Bank of India (RBI) next month. The Centre retained its fiscal consolidation road map, which might convince RBI to reduce the policy rate.

In February, although new orders at services firms continued to rise, the rate of expansion eased to the weakest since last November as firms reportedly faced strong competition for new work during the month.

However, in the sectors that saw growth, businesses reported higher levels of incoming new work. Markit reported that output rose in four of the six major categories, the exceptions being post & telecommunications along with transport & storage, which had shown nil growth in the previous month as well.

A quicker increase in order book volumes in the manufacturing economy proved insufficient to bolster new orders.

“Demand conditions in the country appear to be weak, as indicated by lacklustre increases in new orders. Although PMI data still signal expansions in output and incoming new work, recent figures are considerably low by historical standards,” said Pollyanna De Lima, economist at Markit and author of the report.

Meanwhile in China, the latest data indicated a softening of growth momentum across the service sector, with business activity expanding at only a modest pace. Furthermore, the Caixin China General Services Business Activity Index reading of 51.2 was down from January’s six-month high of 52.4 pointing to a rate of growth that was much slower than the historical series average. Chinese manufacturers saw a further contraction of output in February, with the rate of reduction quickening to the steepest since September 2015.

For domestic services providers, input costs increased further in January, marking a five-month sequence of inflation. Concurrently, purchase costs faced by manufacturers also increased at the slowest rate in five months as falling oil prices acted to partly offset rising import costs arising from the depreciating rupee.

The PMI survey showed February was not very different for job creation compared to previous months. Indeed, the employment sub-index has more or less hovered around the 50-mark throughout 2015. However, higher workloads encouraged service providers to hire additional staff for the second successive month.

Indian services firms continued to pass on higher cost burdens to their clients, as output prices rose again. As with the trend for input prices, charge inflation accelerated but remained relatively weak. The survey said in contrast to this, efforts to boost sales led manufacturers to offer discounts and average charges were lowered for the first time since last September. Manufacturing was up marginally at 51.1 points in February, fuelled by softening price pressures, including input costs. Along with efforts to secure new work, manufacturers lowered their average selling prices in February for the first time in five months. The rate of discounting was, however, only marginal.

“One centre piece of the latest survey results is evidence of fading inflationary pressures, which combined with a stuttering recovery and an increasingly challenging global backdrop open up room for a rate cut,” said De Lima.

The services data also brought down the Nikkei India Composite PMI Output Index, which dipped from January’s 11-month high of 53.3 to 51.2, a reading that was well below the long-run series average (55.7).

)

)