Few eligible candidates for fiscal flexibility

Though the Centre said all 29 states are eligible for market borrowing beyond the fiscal deficit rule, this comes with riders that restrict those eligible to a handful

Indivjal Dhasmana New Delhi The Cabinet had on Wednesday provided flexibility to states for additional market borrowing even if it widened their fiscal deficit by 0.5 percentage points over the prudent limit of three per cent of gross state domestic product (GSDP).

However, not many states would qualify for this, due to riders attached to the scheme by the Fourteenth Finance Commission (FFC).

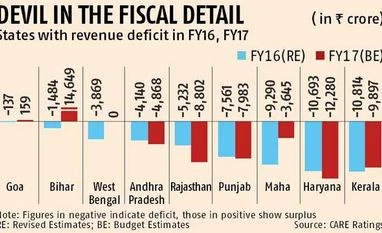

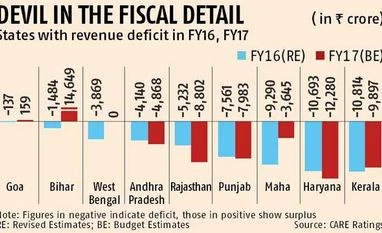

Nine of 18 states studied by CARE Ratings would, for instance, not qualify this financial year, as they had a revenue deficit in 2015-16 or are projected to have it in 2016-17. The FFC had said flexibility in availing the additional limit would be available to a state only if there was no revenue deficit in the year borrowing limits are to be fixed and the immediately preceding year. Out on this count would be both more industrialised ones such as Tamil Nadu and Maharashtra, and less prosperous Bihar. Goa, West Bengal, Andhra, Rajasthan, Punjab and Kerala would also not be eligible to widen their fiscal deficit beyond three per cent.

And, two other riders come with the scheme. One says a state’s debt to GSDP has to be at most 25 per cent in the preceding year. The other is that a state would be eligible if its interest payments are up to 10 per cent of the revenue receipts in the year when borrowing limits are to be fixed. For each of these two parameters, states could increase their fiscal deficit by 0.25 percentage points beyond three per cent. According to a Reserve Bank report on state finances, issued on Thursday, half of India’s states had a debt to GSDP of less than 25 per cent. The other half had over 25 per cent in 2015-16. Telangana was not included in the states studied here.

The states which qualify on both the revenue deficit criteria and debt to GSDP ratio are seven — Chhattisgarh, Gujarat, Jharkhand, Karnataka, Madhya Pradesh, Odisha and Uttarakhand. It should be noted that CARE Ratings took only 18 states out of the total of 29, including Telangana, for their study.

While Arunachal Pradesh had a debt to GSDP ratio at only 4.3, Jammu & Kashmir had 52.3. Mizoram had 48.3 in 2015-16. In terms of the revenue deficit and interest payment to revenue receipt criteria, only five states -- Chhattisgarh, Karnataka, MP, Jharkhand and Odisha would qualify.

These five states are also eligible on the debt to GSDP yardstick and hence could go for the full 0.5 per cent widening of their fiscal deficits. Gujarat and Uttarakhand could have market borrowing that widen their fiscal deficit up to 3.25 per cent of GSDP in 2016-17.

CARE Ratings' chief economist Madan Sabhnavis said the FFC riders are a bit stringent. Also, some states which qualify on fiscal flexibility might not want to utilise it. Gujarat does qualify but it has a very low fiscal deficit to GSDP ratio and even three per cent would be relatively high; they were at 2.2 per cent in 2015-16 (budget estimates).

)

)