Govt wants to 'capture' RBI to control its Rs 9-trn reserves: Chidambaram

In a series of tweets, the former finance minister also claimed that the government and RBI was heading towards a "confrontation" in the Monday's board meeting of the bank

)

Explore Business Standard

Associate Sponsors

Co-sponsor

In a series of tweets, the former finance minister also claimed that the government and RBI was heading towards a "confrontation" in the Monday's board meeting of the bank

)

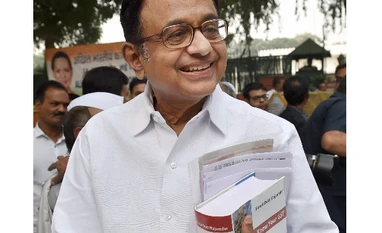

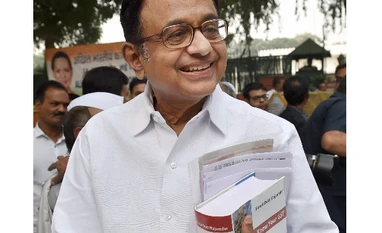

Ahead of RBI Board meeting, Congress leader P Chidambaram Sunday alleged that the central government was determined to "capture" the bank to gain control over its Rs 9 trillion reserves.

In a series of tweets, the former finance minister also claimed that the government and the Reserve Bank of India (RBI) was heading towards a "confrontation" in the Monday's board meeting of the bank.

"Government is determined to 'capture' RBI in order to gain control over the reserves. The other so-called disagreements are only a smokescreen (sic)," he said on microblogging site Twitter.

Chidambaram said, "Nowhere in the world is the central bank a board-managed company. To suggest that private business persons will direct the governor is a preposterous idea."

"November 19 will be a day of reckoning for central bank independence and the Indian economy," he tweeted.

The RBI has a massive Rs 9.59 trillion reserves and the government, if reports are to be believed, wants the central bank to part with a third of that fund — an issue which along with easing of norms for weak banks and raising liquidity has brought the two at loggerheads in the recent weeks.

The government on November 9 had said it was discussing an "appropriate" size of capital reserves that the central bank must maintain but denied seeking a massive capital transfer from the RBI.

Economic Affairs Secretary Subhash Chandra Garg had also clarified that the government wasn't in any dire needs of funds and that there was no proposal to ask the RBI to transfer Rs 3.6 trillion.

"There is no proposal to ask RBI to transfer Rs 3.6 or Rs 1 trillion, as speculated," he had said.

"The government's FD (fiscal deficit) in FY 2013-14 was 5.1%. From 2014-15 onwards, the government has succeeded in bringing it down substantially. We will end the FY 2018-19 with FD of 3.3%. The government has actually foregone Rs 70,000 crore of budgeted market borrowing this year."

Garg said the only proposal "under discussion is to fix appropriate economic capital framework of RBI".

Economic capital framework refers to the risk capital required by the central bank while taking into account different risks.

First Published: Nov 18 2018 | 12:25 PM IST