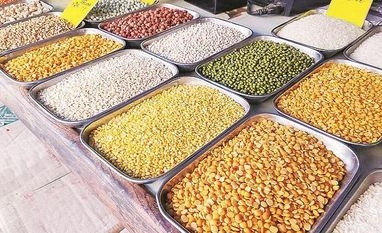

IPGA urges govt to keep retail prices in-sync with wholesale prices

The nodal body for pulses and grains trade and industry in India - has sought to initiate immediate measures to curb the skyrocketing prices of pulses and grains in the retail market.

ANI Business Underlining the rising inflation burden on consumers, including food price inflation, India Pulses and Grains Association (IPGA) - the nodal body for pulses and grains trade and industry in India - has sought to initiate immediate measures to curb the skyrocketing prices of pulses and grains in the retail market.

Retail prices have been traditionally higher than wholesale prices. However, each time a surge in prices is reported, wholesale traders end up bearing the brunt for inflation whereas retailers be it online or offline, organized or unorganized, are seldom under the spotlight.

While there could be a variety of reasons for the difference, the Government or Department of Consumer Affairs needs to take a closer look at the same. At present, there is no regulation on retail prices of pulses leading to an indiscriminate surge in prices leaving the end-consumer to pay exorbitant prices for pulses and grains - which are necessities in any Indian household.

IPGA firmly believes that the need of the hour is to regulate retail prices of pulses and grains, on an urgent basis so that consumers reeling under severe inflation can get some relief.

IPGA has been monitoring retail, wholesale and ex-mill prices of pulses and grains from time to time. IPGA, in June 2021, conducted a study of pulse prices on retail shelves of organized and unorganized retail stores across Delhi, Mumbai, Kolkata and Chennai wherein teams physically purchased pulses from retail outlets. The survey showed that they price spread between wholesale and retail prices is fairly large.

IPGA believes that the Government is targeting the wrong sector. They are focusing on the traders whereas they actually need to conduct an in-depth scrutiny and monitoring of the gap between the wholesale and the retail prices.

They also need to see at what price is NAFED selling their stocks. Even the RBI Annual Report has pointed out the vast difference between wholesale and retail and yet the Government is taking action at the wholesale level or trader level or at the stockist level whereas the rally is taking place at the retail level where the Government is not taking any action.

IPGA strongly urged that the Government or Department of Consumer Affairs devise a process by which the pricing is suitably adjusted to be in-sync with wholesale prices. There has to be some mechanism, some checks and balances which the Government has to devise, through thorough in-depth research.

They need to appreciate that it is the retail sector which is causing the pulse prices to be on fire. It is not the milling or the import or the trading sector wholesale sector.

IPGA also takes this opportunity to request media houses to desist from writing contradictory articles. Media houses need to check prices across various points of sale i.e. mandis, mills, wholesale markets, online sales and retail stores before reporting them or blaming the traders for high prices.

They should also check the ag market website to see where the mandi prices are trading before pinning the blame on the traders because the prices are high at the retail level and not at the level where one is procuring from the farmer.

This story is provided by Hunk Golden and Media. ANI will not be responsible in any way for the content of this article.

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)

)