When the finance minister of a new government presents the full Budget for 2014-15 in June or July, he is likely to pay the price for the excesses of his predecessors.

Towards major subsidies, the new finance minister might have to provide for an additional burden of Rs 1,23,000 crore, a tad more than one per cent of India's gross domestic product (GDP). This is the subsidies expenditure that should have been disbursed in 2013-14, but was rolled over by the United Progressive Alliance government to keep its fiscal deficit lower than the 2013-14 target of 4.8 per cent of GDP.

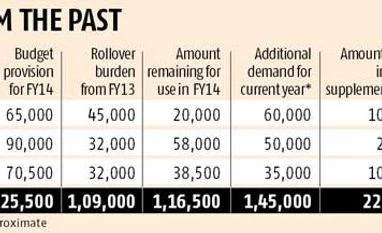

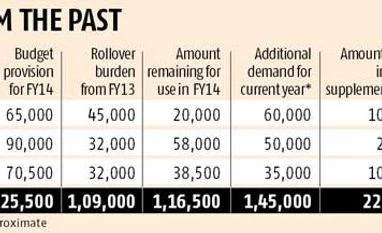

Rolling over the subsidies bill to the next year to report lower fiscal deficit isn't new. Budget 2013-14 had to face the burden of additional subsidies (on account of food, fuel and fertilisers) due to rollover expenditure from the previous year.

However, for 2014-15, the concern will be greater, as the rollover subsidies bill is likely to be 12.8 per cent more than in 2013-14. Experts fear if the rollover is significantly higher than last year's, containing fiscal deficit at 4.8 per cent of GDP wouldn't have much relevance for investors, as well as the central bank (when it reviews the monetary policy), because it won't lead to an improvement in the government's finances.

In the third supplementary demand for grants, to be tabled in this session of Parliament, the finance ministry is likely to meet only a small portion of the additional requirements of the ministries of food, petroleum and fertiliser. Towards these ministries' additional demand of Rs 1,45,000 crore, Finance Minister P Chidambaram is likely to sanction only about Rs 22,000 crore.

"The third supplementary demand will be there, but it will primarily handle small technical issues. Any fresh requirement will have to be met through savings to ensure the net cash outgo is minimal," said a finance ministry official, adding the rollover would be slightly more than last year's.

In Budget 2013-14, the government had provided Rs 65,000 crore for subsidising oil marketing companies (OMCs). Of this, Rs 45,000 crore was to clear the backlog of the previous year, leaving OMCs with Rs 20,000 crore of cash subsidy for this year. This year, their underrecoveries are estimated at Rs 1,40,000 crore; of this, the share of upstream companies is Rs 60,000 crore. The finance ministry is likely to sanction about Rs 10,000 crore in the third supplementary, which means the demand for about Rs 50,000 crore will have to be met from next year's allocations.

"For the period till December 2013, we are seeking an assurance note of Rs 26,000 crore from the government for the next Budget so that even if we don't get any supplementary, it can be passed on to the next Budget," said an OMC executive.

For the food subsidy bill, too, the rollover is likely to be similar. Budget 2013-14 had provided Rs 90,000 crore, including last year's arrears of Rs 32,000 crore. But the food ministry is seeking an additional Rs 50,000 crore, most of which will be given only next year. This is because the finance ministry is understood to have approved only Rs 2,000 crore in the third supplementary demand.

"The amount released by the finance ministry is well below the requirement. But we are managing through the Food Corporation of India's cash-credit facility and bonds of about Rs 8,000 crore," a senior government official told Business Standard.

The fertiliser ministry has sought an additional subsidy of Rs 35,000 crore for this financial year, of which only Rs 10,000 crore is likely to be provided this year. Budget 2013-14 had provided Rs 70,500 crore towards this segment. Delay in subsidy payment will lead to a rise in the finance costs of fertiliser companies.

"There will be rollover of some demand to the next financial year. The quality of fiscal deficit adjustment is a matter of concern, but I don't agree it will hurt growth badly," said Soumya Kanti Ghosh, chief economic advisor, State Bank of India.

)

)