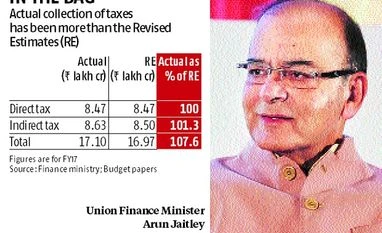

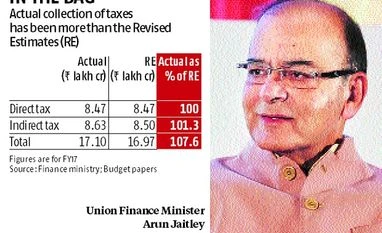

Tax collections at Rs 17.1 lakh crore for 2016-17 exceeded the Revised Estimates (RE) of Rs 16.97 lakh crore by 0.8 per cent, official figures showed on Tuesday. Corporate tax and excise duty collections fell short of RE, which implies that industrial recovery could be prolonged. The tax collection figures in 2016-17 were 18 per cent higher than the previous fiscal year’s figures and the highest growth in the past six years, according to Revenue Secretary Hasmukh Adhia.

With these tax numbers coupled with a spurt in disinvestment proceeds in March, the Centre will be able to rein in its fiscal deficit at 3.5 per cent of the country’s gross domestic product (GDP), as budgeted despite figures till February exceeding the targeted 13 per cent, said Devendra Pant, chief economist, India Ratings. Direct tax collections were Rs 8.47 lakh crore, same as in the RE, and 14.2 per cent higher than in the previous year.

Indirect tax collections were Rs 8.63 lakh crore, higher than RE Rs 8.5 lakh crore, and 22 per cent higher than in 2015-16.

Corporate tax collections grew 6.7 per cent, year-on-year (YoY), lower than the projected 8.97 per cent, largely because of tax refunds. If refunds are included, corporate tax collections are 13.1 per cent higher than in 2015-16.

Income tax (I-T) collections have increased 21 per cent, YoY. Refunds of Rs 1.62 lakh crore were issued, 32.6 per cent more than in 2015-16. Gross personal I-T collections were up 18.4 per cent, YoY.

The Pradhan Mantri Garib Kalyan Yojana, a scheme to boost tax collection announced after demonetisation, did not draw an encouraging response. Sources said collections in this scheme could be lower than Rs 3,000 crore. Prime Minister Narendra Modi had announced the demonetisation of the old Rs 500 and Rs 1,000 notes on November 8 last year.

)

)