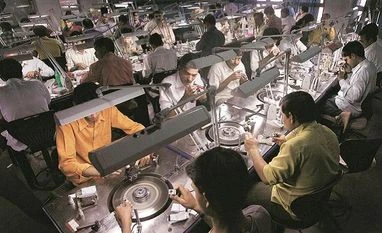

Prime Minister Narendra Modi recently announced as many as 12 measures for the MSME sector in a bid to give them a boost.

The measures include the sanctioning of loans of Rs 10 million for MSMEs registered for the goods and services tax (GST) in just 59 minutes via a new portal. These MSMEs will also get 2 per cent subvention or rebate on incremental new loans of up to Rs 10 million. In addition, their exports will get an increase in interest subvention from 3 per cent to 5 per cent.

Perhaps the measures could have come sooner. According to J James, president, Tamil Nadu Association of Cottage and Micro Enterprises, Coimbatore, MSMEs in the region are on the brink of closure. For these cash-dependent micro industries, the note ban, closely followed by the implementation of the GST, have translated into a double whammy. Delayed payment cycles have led to delayed GST payments, which in turn have attracted penalties.

)