ATM use shows clear decline

While numbers have risen, average daily transaction at each is falling, for various reasons, raising viability issues for brown-label ones

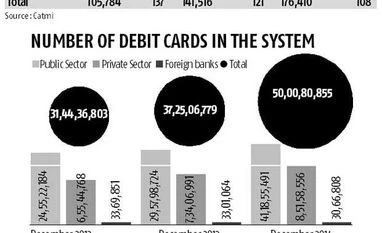

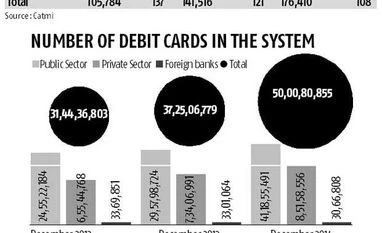

Nupur Anand Mumbai Despite the number of automated teller machines (ATMs) and the debit cards in the system having risen in recent years,the number of average daily transactions on each ATM has been consistently coming down.

This is despite the number of ATMs and of debit cards in the system having risen consistently. If the trend continues, experts said, sustainability of such devices will be an issue.

According to the Confederation of ATM Industry (Catmi), between December 2012 and December 2014, the number of these machines rose from 105,784 to 176,410. However, in the same period, average daily transactions fell from 137 to 108, a decline of 21 per cent. This came as issuance of debit cards rose from 314.4 million to 500 million.

Those in the segment say the average transaction per ATM has fallen because the expectation with which the numbers were expanded hadn't happened. “A couple of years before, banks had anticipated that Direct Benefits Transfer (DBT, of subsidy or welfare payments by the government) would begin flowing into the accounts and more people will be transacting via debit cards. That didn’t happen. With a focus on improving card penetration in the hinterland, ATMs were set up in remote areas but card acceptance there hasn’t also happened as anticipated,” said Amit Tyagi, secretary at Catmi.

Bankers also say better infrastructure in terms of point of sales (PoS) terminals, increased card usage on the online medium and the rise of digital banking has meant a reduction of card usage.

“We’re moving from cash to card as an economy, though it is still nascent. For a lot of things like recharge, shopping, etc, the payment is made only online. Even for small requests like a mini statement, cheque book request, etc, can be done either on the internet or mobile,” said another banker.

There is also ‘cannibalisation’. Bankers explain there are locations with more than one ATM machine but only select ones are used by consumers.

Last year, from November onwards, the Reserve Bank had also allowed banks to charge above five free transactions a month. “With the number of transactions being limited, it has had an impact,” said Aspy Engineer, president of ATM management at YES Bank.

Brown-label ATM (BLA, which are not set up or exclusive to a particular bank) entities are the worst hit. Tyagi says the fall in number of daily transactions has put these "at the brink of unsustainability”. For a BLA to be profitable, there needs to be at least 120-150 transactions a day. However, as of end-December, 2014, there were 63 per cent of onsite ATMs that had less than 75 a day. And, 51 per cent offsite ATMs, too.

Since 2012, BLA entities have installed 36,372 ATMs. With break-even becoming tougher, this has apparently stopped for quite a while. Typically, it takes Rs 4-5 lakh to set up a BLA.

)

)