Avantha calls off life insurance venture with ERGO

JV announced in Nov 2012 stands dissolved; second-time unlucky ERGO begins hunt for new partner

)

Explore Business Standard

JV announced in Nov 2012 stands dissolved; second-time unlucky ERGO begins hunt for new partner

)

Europe-based insurance company ERGO has begun scouting for a new partner for its life insurance business in this country. The Avantha Group, with which it had signed a joint venture (JV) agreement, has decided to withdraw, and the partnership stands effectively dissolved.

ERGO International and Avantha had announced the JV in 2012, to start Avantha Ergo Life Insurance, with ERGO holding 26 per cent stake. The entity had got first-stage approval from the Insurance Regulatory and Development Authority of India (Irdai) and had applied for second-stage approval.

Irdai typically has three stages of approval for starting an insurance company. R1 is an in-principle approval; R2 is granted after evaluating the business model. R3 is the final okay to start operations.

The Avantha Group is a diversified conglomerate, with interests spanning pulp and paper, power transmission and distribution, food processing, energy, infrastructure and information technology. The Group, run by multi-millionaire Gautam Thapar, operates in 90 countries, with about 25,000 employees.

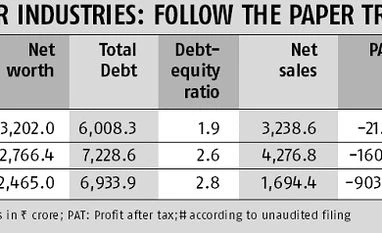

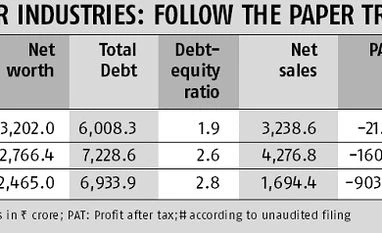

According to sources, Avantha has backed off from the JV after problems at group company Ballarpur Industries escalated the former's debt problems. Last month, Fitch Ratings reportedly raised a red flag on Ballarpur, saying the company might not be able to meet future debt obligations because of dwindling cash flows.

Ballarpur's debt to equity ratio had ballooned to 2.8 in December 2016, from 1.9 at the end of 2014-15. Its cash and bank balance was Rs 6.5 crore at end-December.

"We are going through a restructuring and investments are on hold," said an Avantha Group spokesperson, without specifically commenting on issues related to Ballarpur or elaborating on the reasons for Avantha's departure from the insurance venture.

ERGO is one of the major insurance groups in Europe and part of Munich Re, one of the world's leading reinsurers and risk carriers. Worldwide, ERGO is represented in a little over 30 countries; it concentrates on Europe and Asia.

The life insurance venture with Avantha would have broadened ERGO's product portfolio in India. It already offers non-life insurance products through HDFC ERGO, a joint venture with HDFC Ltd.

"We are unable to comment at this point of time because of regulatory considerations. We thank you for your understanding," said a spokesperson of ERGO Group, in an e-mailed response.

This is the second occasion when ERGO's attempt to start a life insurance venture has met a dead end. It had entered into a partnership with Hero Group in 2008. This was dissolved the subsequent year, in the aftermath of the global financial crisis.

According to sources, Avantha ERGO had hired about 50 people for the business and about half of the team have quit. It could not be ascertained whether they employees left on their own or asked to leave or if they were separately compensated. A text message sent to Deepak Sood, chief executive of Avantha ERGO, did not get a response.

Already subscribed? Log in

Subscribe to read the full story →

3 Months

₹300/Month

1 Year

₹225/Month

2 Years

₹162/Month

Renews automatically, cancel anytime

Over 30 premium stories daily, handpicked by our editors

News, Games, Cooking, Audio, Wirecutter & The Athletic

Digital replica of our daily newspaper — with options to read, save, and share

Insights on markets, finance, politics, tech, and more delivered to your inbox

In-depth market analysis & insights with access to The Smart Investor

Repository of articles and publications dating back to 1997

Uninterrupted reading experience with no advertisements

Access Business Standard across devices — mobile, tablet, or PC, via web or app

First Published: Apr 13 2017 | 11:59 PM IST