Bank earnings preview: Asset quality pressure to ease

Treasury gain to boost earnings but profitability of PSBs to remain under pressure

Nupur AnandAbhijit Lele Mumbai There could be reason for cheer in the banking sector about the July-September quarter on asset quality pressure.

After several quarters, this one is expected to show a decline in new slippages on this measure or for these remaining unchanged.

“We expect a more positive trend in asset quality, with slippages (fresh formation of non-performing loans) peaking or even improving slightly on a q-o-q (quarter-on-quarter) basis. Focus will be on the expanding pipeline of loans being restructured under the 5/25 scheme. Almost Rs 30,000 crore (under this) were done in the past quarter and we estimate an additional Rs 60,000-70,000 crore to be done through FY16,” says a report by Bank of America Merrill Lynch. (The 5:25 scheme allows banks to extend loans for a longer period of time in infrastructure projects, typically 20-25 years, in a bid to match the cash flow. A bank can refinance these every five to seven years).

A report by Kotak had similar views. “We expect slippages to remain closer to the previous-quarter levels, although overall fresh impairments are likely to decline as the restructuring window has been effectively closed for standard loans,” it said.

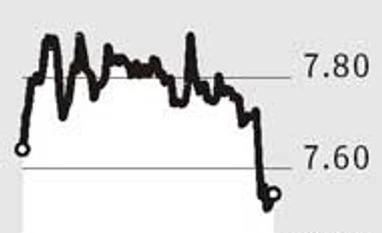

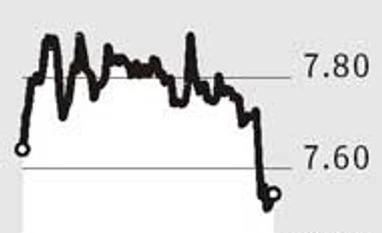

Analysts believe another positive for banks in the quarter ended September will come from treasury earnings. At the quarter’s close, the Reserve Bank of India (RBI) made a sharp 50 basis point cut in the repo rate, to 6.75 per cent. After this, yield on the 10-year government bond fell by 30 bps and ended at 7.54 per cent, lower than at the close of the earlier quarter. This has given banks the benefit of mark to market gains (revaluing on the basis of current prices) on securities. Also, part of the provisioning made earlier for securities could be unwound.

However, the gain on this might not be able to compensate for the weak growth in interest income. As of the latest data with RBI (September 18), credit growth continued to grow in single digits, at 9.6 per cent; deposits also grew at a slow pace, at 11.2 per cent. Tepid credit growth is expected to impact the margins.

“We expect sluggish (growth in) NIMs (net interest margins) due to the lower credit-deposits, subdued credit demand and lower base rates in the first half of this financial year,” said a report by Emkay. Even the base rate (BR) cut undertaken by banks is going to have an impact on NIM. Another report by Religare said margins across the sector are likely to come down by five basis points on a quarter on quarter basis, given the impact of BR cuts in the April-June quarter.

Net interest income is also expected to grow at a slow pace, especially for public sector banks (PSBs), as fee and distribution income hasn’t shown significant improvement.

Considering a rather sluggish credit growth and other income growth, too, profitability of the sector is not expected to stage a significant upside. Ajay Srinivasan, director, industry research, CRISIL, believes PSBs as a group might show a decline in net profit, as provisioning will eat into this. However, private sector banks might show a 10-12 per cent growth in net profit.

)

)