Big firms vie for health insurance pie

M Saraswathy Mumbai In 2006, there was only one stand-alone health insurance company in India. Now, there are five full-fledged ones. What attracts insurers to this segment are rising health costs, low penetration of health insurance, and focus on universal health care, among others.

Recently, Reliance Capital in its annual general meeting (AGM) had said it was looking into setting up a separate health insurance business, which is at present a part of the other product segments under Reliance General Insurance. Reliance Capital Chairman Anil Ambani said the company was open to partnering with global companies in the health care business. Ambani also said the company would lay greater emphasis on the health insurance business.

Similarly, Aditya Birla Financial Services is finalising its plans to enter this space through partnerships. An Aditya Birla Financial Services Group spokesperson said its ambition was to meet all the financial needs of its customers.

“With the way health costs are rising and given the current low penetration, we see significant opportunity and a strategic fit in the area of health insurance and have been examining this space for some time. We are engaged in discussions to finalise our plans in this space,” the spokesperson added.

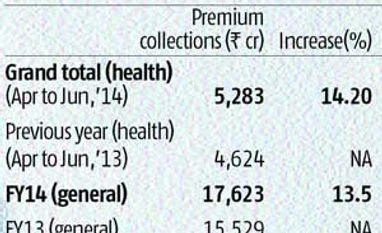

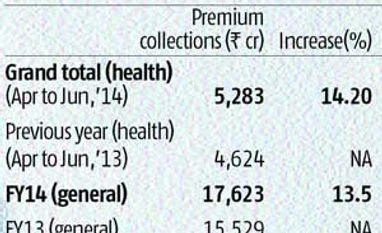

Health insurance premia have stood at Rs 5,283 crore for the April-June period in 2014, a 14.2 per cent uptick in premium collections on the back of the increase in group health business. General insurers collected health premia worth Rs 17,624 crore in FY14 against Rs 15,530 crore in FY13.

According to V Jagannathan, chairman and managing director of Star Health and Allied Insurance, the penetration in health insurance is so low that the new players can never be a threat to the existing ones. “The entry of new players will spread the awareness of insurance to the public more and this will in turn facilitate better sales by all the players.”

Rashtriya Swasthya Bima Yojana (RSBY), a government-sponsored health insurance scheme, has also been a factor that has attracted newer players to this business. Several general insurers operate in this space, so do stand-alone health insurers. The objective of RSBY is to provide protection to below-poverty line households from financial liabilities arising of health shocks. RSBY beneficiaries are entitled to a hospitalisation coverage of up to Rs 30,000.

Naveen Kukreja, group chief marketing officer and director of non-insurance business at PolicyBazaar, said health insurance was an under-penetrated industry in the country, with less than 15 per cent of the population under any kind of health cover.

“The entry of new players in the health insurance space would intensify competition. This, in turn, would lead to cheaper products, improved claim servicing and overall better customer experience,” said Kukreja.

According to sectoral players, since health care inflation is rising at a higher pace than inflation, out-of-pocket expenses have also risen. Hence, more individuals from metros and smaller cities are opting to take a separate health cover, over and above their group covers offered by employers. This means, a greater business opportunity for newer players.

Even international players are interested in this market. A global reinsurer is engaged in discussions with an Indian corporate major to have a stand-alone health business in India.

At present, Star Health and Allied Insurance, Max Bupa Health Insurance, Religare Health Insurance, Apollo Munich Health Insurance, and CignaTTK Health Insurance operate in the stand-alone health insurance space.

)

)