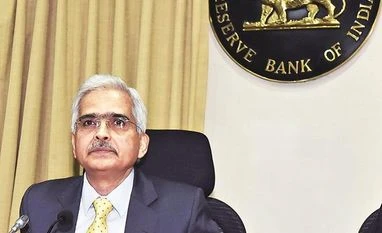

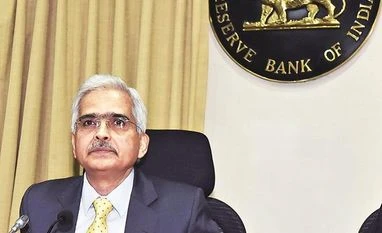

Reserve Bank of India (RBI) Governor Shaktikanta Das on Friday announced a slew of measures to help country's exporters and importers amid a slump induced by the global coronavirus crisis. The announcements were part of the RBI's surprise decision to advance its monetary policy statement by at least 10 days.

In his statement, Das said the monetary policy committee unanimously decided to slash the repo rate, with a 5:1 majority voting in favour of a 40-basis-point reduction to 4 per cent. The reverse repo rate was also brought down to 3.35 per cent. The central banks' stance on inflation and outlook on gross domestic product were also revealed on Firday.

Taking cognizance of the slowdown in the midst of the Covid-19 pandemic, the RBI announced a few measures to help the export-import sector. Das said: "The deepening of the contraction in global activity and trade, accentuated by the rapid spread of Covid-19, has crippled external demand. In turn, this has impacted India’s exports and imports, both of which have contracted sharply in recent months. In view of the importance of exports and imports to the economy, certain measures are being taken to support the foreign trade sector".

Here are some decisions that should help the ailing foreign trade sector:

Extension of time for payment for Imports

Like exporters, the RBI has provided some relief to the importers as well. As the operating cycles have been disrupted for all busineess due to the coronavirus pandemic, the RBI has extended time period for completion of outward remittances against normal imports (i.e. excluding import of gold/diamonds and precious stones/jewellery) into India from six months to twelve months from the date of shipment for such imports made on or before July 31, 2020.

Therefore, businesses will have extra six months to pay their outward remittances, thereby getting a breather to deal with the crisis and not stress their ledgers.

In all, the Reserve Bank has given exporters and importers liquidity support and extra time to manage their dues, which was much needed at a time when the global economy is facing a crisis and uncertainity.

Enable GingerCannot connect to Ginger Check your internet connection

or reload the browserDisable in this text fieldEditEdit in GingerEdit in Ginger×

)

)