High home loan NPAs in public sector banks under lens

Govt asks six public sector banks to take urgent steps to cut slippages

Abhijit Lele Mumbai Banks generally consider housing loans the best bet to grow their secured credit portfolio. While that is often the case, some public sector banks have reported higher level of non-performing assets (NPAs) in their housing loan book.

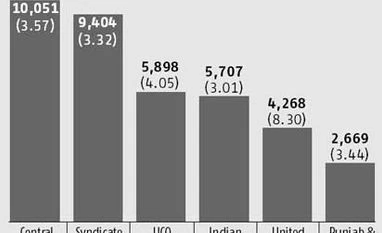

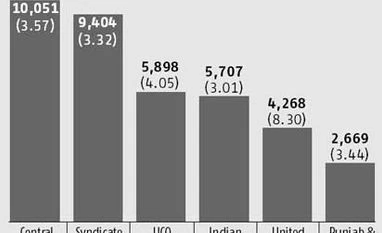

The finance ministry has flagged concern over high home loan NPAs at six public sector banks, including the Central Bank of India, Syndicate Bank, UCO Bank and Indian Overseas Bank.

The ministry's financial services department has asked these banks to do a detailed analysis of their bad loans and work out a plan to reduce slippages, a senior executive said.

According to bank executives, the deterioration in asset quality in housing is predominantly due to the absence of proper due-diligence, frauds and connivance and issues involving title deeds in earlier loans.

Credit flow to the housing sector has witnessed robust growth in recent years. The housing loan book of state-owned banks rose 18.87 per cent to Rs 3.54 lakh crore at the end of December 2013 from nearly Rs 3 lakh crore a year ago. The increase is even better in the priority sector category, according to government data.

Overall housing NPAs (in percentage terms) for PSBs has also come down. Gross NPAs declined from 2.11 per cent in December 2012 to 1.81 per cent in December 2013. However, the overall level (covering the entire credit portfolio and not just housing) of stressed loans (gross NPAs plus standard restructured assets) went up from 11.6 per cent (in December 2012) to 12.6 per cent in December 2013.

The ministry has asked the banks to pay special attention to reducing NPAs in housing as it has implication for overall credit growth.

Among the steps banks will take to stem NPAs in housing are ensuring proper due diligence of proposals, such as physical inspections and increased vigilance.

These steps (to reduce home loan NPAs) were discussed at a meeting Finance Minister P Chidambaram had with the chief executives of public sector banks on March 5.

The suggestions include increasing the accountability of branch managers, especially by making it mandatory for them to visit construction sites before sanctioning housing loans.

PSBs must check encumbrance and title deeds before clearing loans. This is more easily done in rural and semi-urban areas where there should be no case for non-performance.

The ministry has also asked banks to try and bring as many properties as possible under the Central Registry of Securitisation Asset Recon-struction and Security Interest of India (CERSAI). This agency has been created by the government to keep the records of all mortgages deals.

CERSAI has the potential to mitigate problems faced by banks due to multiple mortgages. All transactions of housing loans should be linked to

CERSAI by banks. On its part, CERSAI needs to work out ways and means to incorporate all titles under its net.

)

)