ICICI Bank spars with NPCI over Flipkart's PhonePe: All you should know

Flipkart's PhonePe app asks the user to open a UPI handle on the app

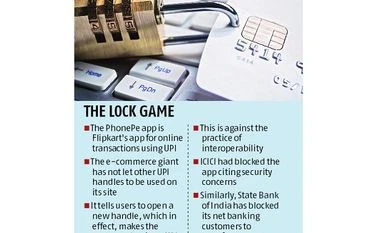

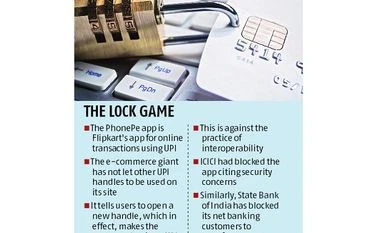

Anup Roy Mumbai National Payments Corporation of India (NPCI), the developer of the Unified Payments Interface (UPI), on Thursday asked ICICI Bank to unblock transactions made on Flipkart’s PhonePe app immediately, to which the bank said the app must first allow interoperability.

Flipkart’s PhonePe app asks the user to open a UPI handle on the app. Users cannot use their UPI handles of other banks, say bankers. Flipkart and Yes Bank have come together to launch PhonePe.

An ICICI Bank spokesperson said: “A certain non-banking application is following a restrictive practice of allowing only users of its own UPI handle to make payments on its app. This is a clear violation of the UPI guidelines which mandate interoperability, wherein users enjoy the freedom to choose any UPI handle to make payments.”

The ICICI Bank statement said: “NPCI has assured us in writing that this will get corrected very soon and the concerned app will allow interoperability. As soon as this is corrected, ICICI Bank will start allowing UPI transactions to resume on this App.”

The biggest private sector lender had blocked transferring funds through the PhonePe app.

NPCI, in its statement earlier, had said ICICI Bank should free the transactions “immediately”.

“We had a discussion with ICICI Bank and Yes Bank — the banker to PhonePe to review the matter and arrived at this,” NPCI said, adding, “we have also advised banks to adhere to the merchant on-boarding guidelines meticulously from the angle of interoperability of merchant app so that such disputes are avoided”.

The idea behind the UPI is to make transactions easy and not keep them limited to the banking channels. Aadhaar-based apps developed by banks will tap in to the UPI system to execute deals.

Currently, non-banks and wallet companies are not allowed to participate in the UPI but they will be able to do so. Besides, wallet companies, once they turn into payments banks, will automatically get access to UPI systems.

State Bank of India has prevented its net banking customers from transferring money to Paytm. The lender has recommended its customers use the bank's wallet app SBI Buddy.

)

)