Revival some time away for life insurers

The segment will continue to see contraction, at least for the first six months of this fiscal

M Saraswathy Mumbai In the April 2012-February 2013 period, the life sector's industry's new business premium collections fell 6.1 per cent, compared to the corresponding period of the previous financial year. Insurers say the segment would continue to see contraction, at least for the first six months of this financial year, owing to new traditional product guidelines and slow economic growth.

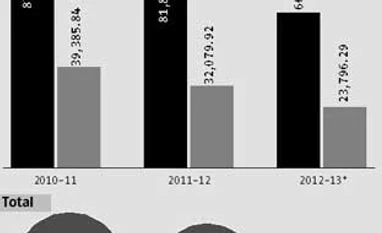

According to data collected by Insurance Regulatory and Development Authority (Irda), total new business premium collection of life insurers in the April-February period stood at Rs 84,501.74 crore; in the corresponding period of the previous financial year, it stood at Rs 90,015.83 crore. Private life insurers collected Rs 23,796.29 crore, a fall of 5.5 per cent, compared to the corresponding period of the previous financial year.

GV Nageswara Rao, managing director and chief executive of IDBI Federal Life Insurance, said, "We do not expect any substantial revival this financial year. Companies would focus on redesigning their product suite in the initial period and the number of products could also fall."

The Irda has announced new guidelines for linked and non-linked insurance products. The guidelines have called for non-linked variable insurance products (index-linked products) to be treated on a par with unit-linked products. Insurers have been given time till June 30 and September 30 to re-file their group and individual products, respectively.

G Murlidhar, managing director of Kotak Old Mutual Life Insurance, said he had a conservative outlook for this year. "It has more to do with the macro-economic environment. The industry will feel the heat," he said, adding since India was hugely underinsured, the prospects were definitely bright.

Insurers fear they may lose customers due to the fact the first few quarters wouldn't see new products; this would hit new business premiums. The chief product officer of a private life insurance firm said the company, along with most life insurance companies, would focus on re-filing products, rather than launching new ones. "Hence, customers looking for variety may be disappointed," the official said.

However, Sanjay Tiwari, HDFC Life vice-president (strategy and product), is optimistic. He said the finalisation of the guidelines had removed uncertainty in the industry. "The industry will now have to sensitise customers about the changes. This may pave the way for positive growth," he said.

)

)