The rupee ended weak on Tuesday despite starting on a positive note due to dollar buying by banks and importers. Government bond yields, on the other hand, rose on speculation that the central bank may accelerate efforts to mop up extra cash from the financial system.

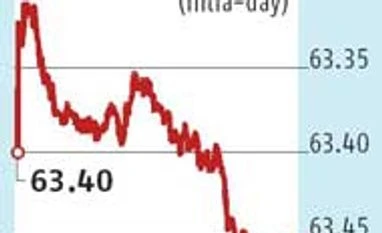

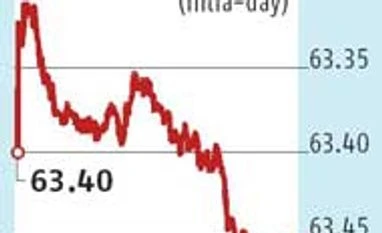

The rupee ended at 63.46 compared with the previous closure at 63.40 a dollar. It had opened at 63.31 on Tuesday, and during intra-day trades it touched a low of 63.48.

“The rupee depreciated against the dollar on Tuesday, tracking weak Asian peers. The currency started the session on a positive note as investors sold dollars. However, suspected intervention by the Reserve Bank of India (RBI) arrested early gains from expectations of further foreign fund inflows. Furthermore, the domestic equity markets erased all gains and ended weak on Tuesday. This also influenced weakness in the rupee,” said Suresh Nair, director, Admisi Forex India.

The yield on the 10-year benchmark bond ended at 7.96 per cent compared with the previous close of 7.94 per cent. Government bonds snapped a five-day gaining streak, on speculation that RBI may accelerate efforts to mop up extra cash from the financial system.

ALSO READ: Govt says India insulated from Greece fallout; rupee may get hit “Sentiment is hurt by speculation that the central bank might try to mop up surplus liquidity. However, the market isn’t prepared for any additional supply of bonds other than those scheduled,” said Debendra Dash, assistant vice president (money market), DCB Bank.

Meanwhile, on Tuesday, RBI Deputy Governor Urjit Patel told a news channel inflation has come down and the financial condition is much better, but macro conditions have not changed significantly since the June 2 monetary policy for RBI to cut rates further. Since the start of 2015, RBI has cut the repo rate by 75 basis points which currently stands at 7.25 per cent.

“Our stance has not changed since our last policy statement, that you know; as we go forward this decision will essentially be data-dependent and we will see how the path of consumer price index (CPI)-based inflation pans out over the short and medium term and then take a decision accordingly regarding the interest rate,” he told a new channel.

Patel also said India is on a fiscal consolidation path and the external situation in terms of funding the current account deficit should not be a problem. Patel believes growth pick up will be supportive.

)

)