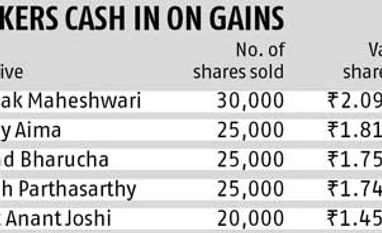

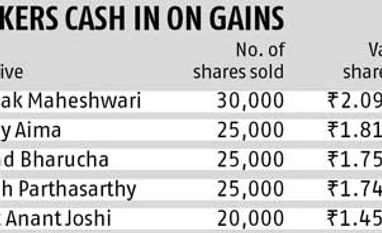

Senior HDFC Bank execs sell shares as they hit 52-week high

Together, 21 senior officials sold holdings worth about Rs 32 crore in three days

Mumbai Close to two dozen senior executives of HDFC Bank have trimmed their own stakes in the private lender in the past three trading days, when the share hovered around a 52-week high. The scrip hit a 52-week high of Rs 740 on Tuesday before closing at Rs 725, an almost 15 per cent gain in a month.

Together, the 21 senior officials sold HDFC Bank shares worth about Rs 32 crore in three days. On an average, each would have pocketed Rs 1.5 crore through these sales. The bank did not respond to an email sent by Business Standard on the matter.

While it is usual for executives to buy and sell shares of the company they work with, such transactions are of interest to outside investors because of the perception that insiders know best how a company fares. In this case, analysts said the selling could have been prompted by the ‘phenomenal’ run-up. “The stock has rallied so much that it makes sense for these executives to sell their holdings. They must have been getting these ESOPs (employee stock option plan allocations) for long and must have decided to take advantage and cash out,” said Vivek Mahajan, head of research, Aditya Birla Money.

In the past year or so, HDFC Bank shares have fluctuated between Rs 600 and Rs 700.

Since end-August 2013, when the stock hit a 52-week low of Rs 528, it has rallied as much as 40 per cent. In the past couple of years, the bank has been considered one of the safest bets among stocks in the sector, offering steady returns in uncertain times. “The stock does not disappoint the markets at all. But nothing has dramatically changed in their business to suggest growth has improved in the company,” said U R Bhat, managing director, Dalton Capital Advisors.

With every big investor owning the stock and the foreign institutional investment (FII) limit hitting the maximum level permitted, many analysts were forecasting limited gains. “I would say the stock is fairly priced or fully priced at this point and I see no reason for any major upside for the stock,” said Sudip Bandhopadhyay, managing director, Destimoney Securities.

Analysts said a further rise would be contingent on the raising of the FII investment limit in the stock. The bank has already approached the Reserve Bank for permission to increase FII investment limits in its equity to 49 per cent. “If that happens, then the stock could see some further gains. But as of now, the upside remains capped,” said Mahajan.

)

)