China cut its benchmark reference rate for mortgages by an unexpectedly wide margin on Friday, its second cut this year as Beijing seeks to revive the ailing housing sector to prop up the economy.

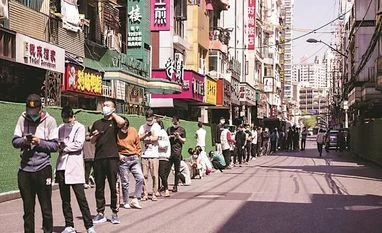

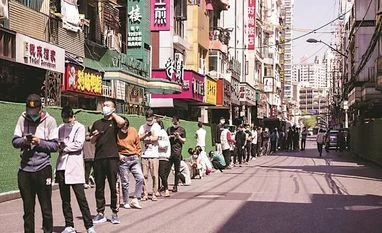

Senior officials have pledged further measures to fight a slowdown in the world's second-biggest economy, hit by Covid-19 outbreaks that prompted stringent measures and mobility restrictions, causing huge disruptions to economic activity.

Many market participants believe Friday's move was also a response to Premier Li Keqiang's call to decisively step up policy adjustments and strive to let the economy return to normal quickly.

The country's benchmark stock index, Shanghai Composite Index, rose roughly 1% in early trading on the rate cut on Friday, but property shares were flat.

China, in a monthly fixing, lowered the five-year loan prime rate (LPR) by 15 basis points to 4.45%, the biggest reduction since China revamped the mechanism in 2019.

The one-year LPR was unchanged at 3.70%.

Many private-sector economists expect China's economy to shrink this quarter from a year earlier, compared with first quarter's 4.8% growth. Indicators from credit lending, industrial output and retail sales showed Covid-related stringent measures and mobility restrictions have taken a heavy toll.

A key drag on growth has been the property sector, which policymakers are seeking to turn around. Property and related sectors such as construction account for more than a quarter of the economy.

The LPR is a lending reference rate set monthly by 18 banks and announced by the People's Bank of China. Banks use the five-year LPR to price mortgages, while most other loans are based on the one-year rate. Both rates were lowered in January to boost the economy.

Friday's cut suggests that "China's economic growth was facing increasing resistance this year," said Marco Sun, chief financial market analyst at MUFG Bank.

"Cutting the five-year LPR was an attempt to accelerate recovery of the real estate sector," Sun said, adding that the authorities refrained from cutting the one-year rate because of recent ample liquidity conditions in the banking system refrained authorities from lowering the one-year LPR.

Eighteen of 28 traders and analysts in a Reuters poll had forecast a reduction in either rate, including 12 who expected a 5-basis-point cut for each tenor.

A campaign by the authorities to reduce high debt levels became a liquidity crisis last year among some major developers, resulting in bond defaults and shelved projects, shaking global financial markets.

Since the end of last year, Beijing has taken steps to help revive the property sector. Those included making it easier for large and state-owned developers to raise funds, relaxing rules on escrow accounts for pre-sale funds and allowing some local governments to cut mortgage rates and down-payment ratios.

This week, financial authorities allowed banks to cut their mortgage loan interest rates for some home buyers. But that measure and Friday's cut alone will not ease the financing stresses for developers, many of whom are struggling to refinance debt..

Property shares have rebounded recently, but the muted reaction to Friday's cut suggests some investors think it may not be enough to revive the struggling sector.

"Policymakers might have reached a consensus whether to revive the property sector," said Xing Zhaopeng, senior China strategist at ANZ, predicting further easing measures.

Shanghai Issues back-to-Office Rule for Bankers

Shanghai issued detailed rules for financial firms in the city’s Pudong district to resume operations after signs that a major Covid-19 outbreak has been put under control. Under the rules, employees returning to work must not exceed 40% of total staff of a financial institution.

)

)