Euro gains, commodities slide, rouble weakens

Greek Prime Minister-elect Alexis Tsipras formed an alliance with Independent Greeks within hours of his election victory

Bloombeerg London The euro rebounded from an 11-year low on speculation fallout from the election of the anti-austerity Syriza party in Greece will be contained. European stocks erased earlier losses, while oil and copper led commodities lower and Russia's rouble weakened.

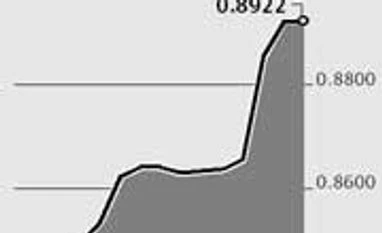

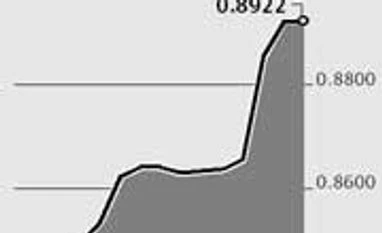

Europe's shared currency strengthened 0.2 per cent to $1.1229 by 7:05 am in New York. The Stoxx Europe 600 Index advanced less than 0.1 per cent after closing at a seven-year high on Friday, while Standard & Poor's 500 Index futures slipped 0.3 per cent. Greek stocks fell with bonds. The rouble tumbled 2.4 per cent as fighting in Ukraine spread. Oil dropped from the lowest closing price in almost six years, copper slid one per cent in London and gold declined.

Greek Prime Minister-elect Alexis Tsipras formed an alliance with Independent Greeks within hours of his election victory. German business confidence rose for a third month as falling energy costs and anticipation of more European Central Bank stimulus helped lift optimism about an economic recovery. Microsoft Corp and Texas Instruments Inc. are among companies reporting earnings.

"Syriza's win won't be as bad for markets now as it could have been a few months ago," said Alessandro Bee, a strategist at Bank J Safra Sarasin AG in Zurich. "Tsipras is less aggressive and willing to negotiate. The result will affect sentiment on Greece, but in a broader European context it's just a blip. Markets are still in a risk-on mode and any news is dwarfed by the ECB stimulus program."

Debt negotiations Tsipras, has pledged to keep the nation within the single currency area as he negotiates a writedown of Greek debt and eases budget constraints that were imposed in return for aid after the country's economic collapse. The current round of funding expires on February 28 and talks with the so-called troika - the International Monetary Fund, the European Commission and the ECB - for its renewal have stalled since September amid demands for further belt tightening.

The Independent Greeks party will support Syriza in a vote of confidence set for February 5, its leader Panos Kammenos said. As recently as last week, Kammenos said that Greek debt should be audited and its "odious" part written down, whether creditors like it or not.

"If you are a broad European investor you should be relatively relaxed," Michael Krautzberger, the London-based head of euro fixed income at the world's biggest money manager BlackRock Inc said in an interview on Bloomberg Television's "The Pulse" with Francine Lacqua. "If you look at the long end in Italy, the long end in Spain, they are actually up in price, down in yield. If the market were super concerned about spillover we wouldn't have those reactions."

ECB shield

Spanish and Italian sovereign securities erased earlier declines on speculation the ECB's newly announced bond-buying plan may shield those nations' securities from any selloff in Greece. Italy's 30-year yield fell 12 basis points to 2.56 per cent and the rate on similar-maturity Spanish debt dropped six basis points to 2.36 per cent and Portugal's declined 12 basis points to 3.38 per cent.

Greek 10-year bonds fell, pushing the yield on the 2025 securities 55 basis points higher to 8.96 per cent, after the rate dropped 56 basis points on January 23. The benchmark equity gauge declined 1.8 per cent, paring a 6.1 per cent gain on Friday.

Currencies perceived as havens were among the biggest losers versus the 19-nation euro. The Swiss franc weakened 1.3 per cent to 99.89 centimes per euro and the yen slipped 0.7 per cent to 132.83 per euro.

Airlines rally

Three shares advanced for every two that declined in the Stoxx 600, with trading volumes 19 per cent greater than the 30- day average, data compiled by Bloomberg show.

Automakers and airlines led gains while commodity producers in Europe declined. Aer Lingus Group Plc added 1.5 per cent and International Consolidated Airlines Group SA climbed 3.3 per cent as the Irish carrier is mulling IAG's takeover offer.

Delhaize Group, the owner of the US Food Lion stores, advanced 4.6 per cent after reporting that preliminary underlying operating profit was better than estimated in 2014.

S&P 500 futures expiring in March were little changed after the index posted its first weekly gain of the year. About 77 per cent of the 90 companies in the S&P 500 that have posted earnings this season have beaten analyst estimates, while 51 per cent have topped sales projections, data compiled by Bloomberg show.

The MSCI Emerging Markets Index fell for the first time in five days, declining 0.3 per cent from an eight-week high. Russia's Micex slid 2.1 per cent and the rouble weakened after its first weekly advance this year.

Russia warned

The US and the European Union warned that Russia may face further repercussions after a rocket attack on the port city of Mariupol on Saturday. The US, NATO, and the OSCE said the attack came from rebel-held territory and the separatists blamed Ukrainian government forces.

President Barack Obama said the alliance of the US and European governments must remain unified and EU foreign affairs chief Federica Mogherini called an extraordinary meeting of foreign ministers for January 29. Russia consistently denies military involvement. A new convoy of trucks carrying what Russia says is humanitarian aid will head for eastern Ukraine early on January 27, RIA Novosti reported, citing the Emergencies Ministry in Moscow. Ukrainian troops faced 115 rebel attacks in the past 24 hours, military spokesman Leonid Matyukhin said on Facebook.

Gulf Stocks

The Dubai Financial Market Index slid 3.6 percent, falling for a second day, and Abu Dhabi's benchmark gauge lost 0.8 percent. Saudi Arabia's Tadawul All Share Index rose 0.8 percent trading resumed following the death of King Abdullah on Jan. 23.

The Shanghai Composite Index climbed 0.9 percent to the highest close since August 2009, with trading volumes 23 percent less than the 30-day average, according to data compiled by Bloomberg. The Hang Seng China Enterprises Index of mainland companies listed in Hong Kong dropped 0.3 percent, ending a four-day rally.

Commodities have fallen 4.2 percent this month, heading for their first January decline in five years amid surging supplies of crude oil and slowing global economic growth.

West Texas Intermediate crude slid from its lowest closing price since March 2009, trading 1.6 percent lower at $44.85 a barrel. Brent crude was down 2.1 percent to $47.79 a barrel. U.S. oil erased gains spurred by the death of King Abdullah of Saudi Arabia on Jan. 23 after his successor said policies won't change in the world's largest crude exporter.

Flights Canceled

Gold slipped 0.8 percent to $1,284.28 an ounce while silver dropped 1.6 percent. Copper slid as much as 3.3 percent to the weakest since July 2009, nickel fell 0.8 percent and lead lost 0.6 percent.

A blizzard forecasters call "life-threatening" may drop three feet of snow from New York to Boston. The storm has caused more than 1,700 flight cancellations and will likely block road and rail traffic, close schools and knock out power across the U.S. Northeast. New York Governor Andrew Cuomo advised commuters to consider working from home.

U.S. natural gas futures fell 13.1 cents, or 4.4 percent, to $2.855 per million British thermal units in electronic trading on the New York Mercantile Exchange.

)

)