7,600, 7,840 key levels for Nifty

Devangshu DattaThere was a correction immediately after settlement with a sharp fall on last Friday. A partial recovery on Monday leaves the market intriguingly poised. The Reserve Bank of India (RBI) credit policy on Tuesday could be a key input in deciding the market trend.

Consensus expectation is that the RBI will leave rates unchanged but some optimists expect a cut. If the central bank cuts policy rates, there could be an upswing. There's more chance of a possible cut in the cash reserve ratio. If RBI doesn't touch either cash reserve ratio (CRR) or policy rates, the market could see some correction. If RBI does raise rates or CRR, there would probably be a sharp drop.

The breadth and volume signals are mildly negative. Declines have outnumbered advances over the past week. Volumes are slightly down. Retail sentiment is bearish. Domestic institutions remain net sellers, while FIIs remain net buyers.

The upside levels to watch are the alltime highs at Nifty 7,840-plus. A rate cut could trigger a move past those levels. On the downside, the support at 7,600 held on Friday, August 1. If that breaks, support at 7,425-7,450 could be tested. A drop below 7,400 would be bearish. If 7,400 breaks, the market could fall till 7,200. Day traders can assume that support-resistance levels exist at roughly 50-point intervals.

RBI is likely to be cautious because the fighting in West Asia could impact crude prices at any stage. That could trigger a sell-off in Indian equity. The monsoon has improved but it is likely to remain sub-par. This creates possible upwards pressure on food prices. Against that, the June data suggests inflation is slowing which is why the optimists are hoping for a cut.

Obviously, the Bank Nifty would be a key driver if a trend develops. The financial index could move between 14,900 and 15,600 and it is likely to see premiums of 100-odd points on the August future versus spot. After the review, it may climb sharply and hit all time highs above 15,750, if there's a rate cut. Otherwise, it's liable to settle at the lower end of that 14,900-15,500 zone.

If the rupee stays inside the 59.5-61 zone versus the dollar, it will not be a big influence on the market. But any weakness could lead to hedging into information technology (IT) stocks. If crude rises, rupee weakness is a possible outcome. Technical indicators suggest that there is already quite a bit of hedging into IT stocks, so the smart money could be expecting rupee weakness.

The Nifty's put-call ratio (PCR) looks healthy with August PCR and the three-month PCR both hitting 1.1 levels. The VIX has dropped, which is a sign of lack of fear but relatively low premiums imply the market is under-estimating the potential for a big move.

Traders are quite prepared for a run till 8,500 or a selloff down till 7,200 if we examine the option chains. There is ample open interest (OI) in the August 8,500c though the call OI peaks at Aug 8,000c. In the puts, there is OI down to Aug 6500p but the peak is at 7,000p with big bulges at 7,300p and 7,500p. The August carryover has been reasonable.

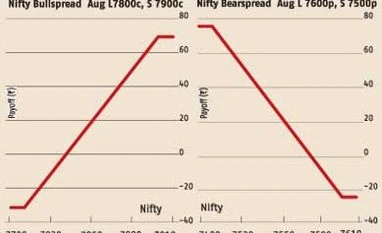

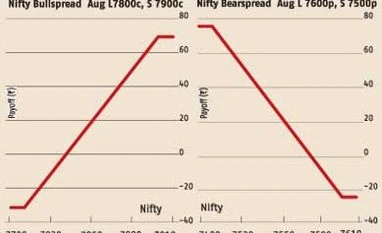

The spot Nifty index is at 7,683 with the futures at 7,725. An August bullspread of long 7,800c (70) and short 8,000c (38) costs 32 and maximum payoff is 68. An August bearspread of long 7,600p (67) and short 7,500p (42) costs 25 and has a possible payoff of 75. If these two spreads are combined, the resulting long-short strangle costs 57 and the maximum return is 43 with breakevens at 7,543, 7,857.

)

)