Trend seems bullish across time frames

Devangshu DattaThe bulls still retain the upper hand going into the Budget though there is some nervousness about inflation. The budget could intensify bullish sentiment or lead to a sharp correction. Apart from the likelihood of a poor monsoon, fighting in Iraq could impact the energy market. The FIIs remain net buyers. Retail sentiment is also strong. Domestic institutions remain cautious. There is ample cause for volatility and we may see high volatility until the Budget is discounted, one way or other.

Most indicators suggest the market is over-bought. However, the indicators have been overbought since the election results came in and the market has broken out to successive new highs. The trend seems bullish in all time frames. On the downside, there is support at 50-point intervals on the Nifty.

Apart from Budget-related rumours, which are generally bullish in nature, one reason for volatility could be a focus on the energy sector. The Iraq situation is not going to be resolved quickly. This means international crude prices will fluctuate with fears of supply disruptions. Brent prices have reduced from recent highs of $115 a barrel but energy prices could spike up again if fighting intensifies. There will be high volatility across Indian energy stocks because there are expectations of reforms on the oil and gas subsidy front to balance the potentially massive pressures on the import-dependent refining sector.

A poor start to the monsoon, with major rainfall deficiency, has also put pressure on the financial sector. In effect, a poor monsoon makes rates cuts by the RBI unlikely for the next several months. The Bank Nifty should therefore, not be a major contributor to rallies at this moment. In fact, there is a case for going negative on banks because a rate hike cannot be absolutely ruled out. However, there are hopes that an acceleration in GDP will help reduce the level of non-performing assets and also, there could be some Budgetary provisions favouring investors in PSU banks.

Selling pressure on the rupee would be a given if crude prices rise. But a lower rupee could even be useful in that it would boost exports. The IT sector could perform its customary role as a hedge against a low rupee. There is a chance that the pharma sector will also receive attention from bulls.

Underlying retail sentiment is very positive with small caps and midcaps outperforming large caps.

But the post-Budget mood is likely to be set by FII action and, to a lesser extent, by DIIs. If the institutions like the Budget, the mood will remain positive.

Premia on the Nifty option chain remains extremely high. Open interest implies that traders are braced for a move till either 6,900-7,000 or till 8,500 within the next 10 sessions. The put-call ratios (PCR) remain bearish at around 0.86 for the July settlement and for the next three months overall.

The Nifty closed at 7,787 on Monday. A long straddle at 7,800 is very expensive, costing 304, with 7,800c (151) and 7,600p (153). The breakevens are at 7,496, 8,104. It's possible to sell this straddle with gains if the market stays within 7,500-8,100 until settlement (July 31). Or perhaps, buy long 7,400p (35) and long 8,200c (27) to protect against a big post-Budget move.

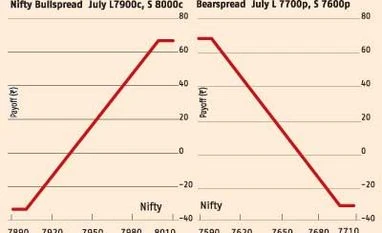

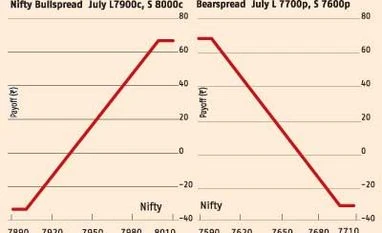

A bullspread of long 7,900c (104) and short 8,000c (69) costs 35 and pays a maximum 65. This is expensive, given distance from money. A bearspread of long 7,700p (111) and short 7,600p (79) is at the same distance and costs 33 while pays 67.

)

)