These could still be early signs, but it appears the breather on food inflation that India has been enjoying for some time is going to end. Following a sharp reduction in production estimates, prices of key agricultural commodities have risen over the past three weeks.

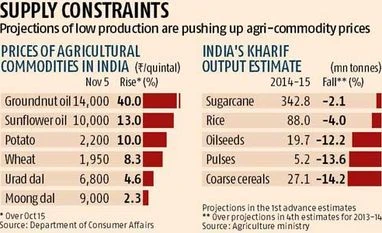

According to data from the Union food ministry, the wholesale prices of edible oils have increased up to 40 per cent since October 15, while pulses and wheat have become costlier by 4.62 per cent and 8.33 per cent, respectively. The trend has been similar in global markets as well, with agri-commodity prices surging up to 6.55 per cent.

The rate of wholesale inflation in India had hit a near-three-year low of 3.52 per cent in September, mainly because of lower food prices until recently.

“We have reports of lower kharif output. So, prices normally tend to go up. The extent of the price rise is a function of demand and supply, which will be determined after actual arrivals in the market. Pulses will remain elevated. But global output and the government’s export policies will determine the prices of other commodities like edible oils and sugar,” said Madan Sabnavis, chief economist, Care Ratings.

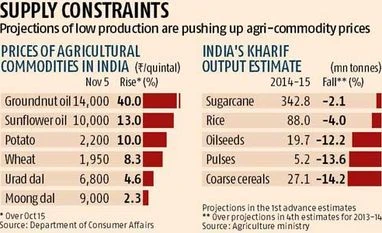

The forecast of a lower kharif output has started weighing on agri-commodity prices. The United Nations’ Food and Agriculture Organization (FAO), too, also scaled down its earlier production estimates. It has said that India’s kharif cereal output will contract due to the El Niño weather anomaly, which delayed monsoon and caused deficient rains.

According the FAO, India’s cereal output this year could be 290.6 million tonnes, two per cent lower than last year’s 296.5 million tonnes. In its report in July, the world body had estimated the country’s cereal output to be 297.2 million tonnes. In its latest report, it also reduced its projection for global cereal production to 2,522 million tonnes, 3.7 million tonnes lower than in 2013.

In line with the FAO estimates, India’s agriculture ministry, in its first advanced estimates, has projected the country’s kharif foodgrain output to be 120.27 million tonnes, a third straight season of decline — the production was 129.24 million tonnes last year, 128.07 million tones in 2012-13 and 131.27 million tonnes in the year before that.

While India’s production of rice, wheat and sugar continues to be surplus, a deficit in supply of pulses and edible oils has made it import-reliant. A deficient monsoon has lowered the country’s kharif crop acreage this year and a decline in agricultural output globally (including in India), is expected to keep prices, especially those of edible oils and pulses, high.

“After bottoming out at 1,914 ringgits on the Bursa Malaysia in September, crude palm oil has recovered to trade at around 2,300 ringgits at present. I still expect the price of palm oil to rise steadily, as a decline in production begins to bite and stocks are depleted. The worst is over for oilseed farmers, crushers and processors,” said Dorab Mistry, director, Godrej International.

A slowdown in production of palm oil in Indonesia and Malaysia, combined with a revival in the global import demand, has supported the price increase.

India imports 3.5 million tonnes of pulses and over 12 million tonnes of edible oils to meet its demand of 23 million tonnes and 19.5 million tonnes, respectively - mainly from Myanmar, Canada and Australia. India's import of pulses is hit when the exporting countries report crop damage.

Meanwhile, FAO has reported the Sugar Price Index at 237.6 points for October, a brisk 4.2 per cent increase over the previous month, due largely to a drought in parts of Brazil which has led to fears that the sugarcane crop might be smaller than expected. Despite the month's gains, international sugar prices remain more than 10 per cent below their October 2013 level.

"For mills' survival, sugar prices have to go up," said Sanjay Tapriya, chief financial officer of Simbhaoli Sugar Mills. India's sugar production is expected to decline due to a delay in crushing in Uttar Pradesh and a massive cane diversion to jaggery units (kolhus) resulting in lower availability for mills.

Sudhir Kumar, secretary, Food & Public Distribution, has pegged India's sugar output at 25.05 million tonnes for 2014-15, against the government's previous estimates of 25.5 million tonnes. This year's sugar output, however, will remain higher than consumption, estimated at 24.5 million tonnes.

)

)