AU Financier, now known as AU Small Finance Bank, drew a lot of eyeballs back in October 2015. It was the only asset-based non-banking finance company (NBFC) among the 10 names which were awarded an SFB or small finance bank licence. The nine other awardees were micro finance institutions. This partly explains the interest around its Initial Public Offer (IPO). What amplifies the interest is AU’s journey from an unorganised financier to a regional NBFC and now to become an SFB.

Operations A business that commenced in 1996 for financing vehicles was associated with HDFC Bank as its partner in 2005. Since then, it has seen multiple rounds of private equity funding. Motilal Oswal supported it in the early stages; Warburg Pincus, IFC, ChrysCapital and Kedaara pitched in at later growth phases.

With multiple investors coming in, the focus of AU expanded. While catering to the underserved is its stated key principle, small and medium enterprises (SMEs) and micro SMEs are now among its prime focus areas. The average loan is Rs 10-11 lakh for MSME and Rs 2 crore for SMEs. The two businesses have also been the fastest growing avenues for AU, with assets under management (AUM) compounding annually at 55 per cent and 78 per cent, respectively.

The NBFC also had a significant housing loan portfolio; this had to be hived off in 2016 to meet the SFB norms. Going ahead, housing loans would be a new segment the SFB would enter, apart from personal loans and gold loans.

Financials As the AUMs sharply compounded from Rs 3,704 crore in FY13 to Rs 10,734 crore in FY17, the financials have seen equally exponential growth (see table). What will come handy in aiding growth is the Rs 516 crore of profit it earned from divesting its housing finance business. A combination of this profit and fund raising in 2016 had boosted its capital adequacy to 23.2 per cent as on end-March.

While the numbers offer adequate comfort, investors need to acknowledge the expansion plans ahead for the next 12–18 months. For instance, the SFB aims to open 168 branches in FY18. If the experience of Ujjivan and Equitas are extrapolated, one needs to factor in for higher operating expenses. This could, in turn, dampen the pace of revenue and profit growth in the coming years. Equitas and Ujjivan have seen their cost to income ratios increase from 51 per cent in FY16 to 54 per cent in FY17, and 53 per cent in FY16 to 63 per cent in FY17, respectively. With the transition phase continuing, the ratios might further increase in FY18.

Likewise, building a liability franchisee would also entail higher costs, particularly with the competition among SFBs to lure customers. Therefore, it would be interesting to see how AU maintains its net interest margin at 9.7 per cent.

Asset quality might also see some moderation in the coming years. The transition from 150 days per dues (DPD) to 120 DPD (reduction in non-performing asset recognition) resulted in the gross NPA ratio jumping from 0.6 per cent in FY16 to 1.6 per cent in FY17. This could see a further rise if NPAs were to be adopted on a 90 DPD basis by FY18.

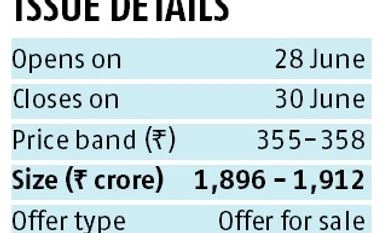

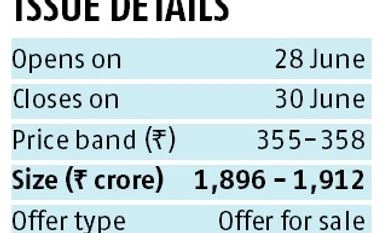

Valuations

At 5.3, the FY17 price to book ratio on a post IPO basis, the SFB appears expensive to most of its listed peers such as Ujjivan, Equitas, Capital First and Shriram City Union. These trade between two and four times the FY17 price-to-book. Considering the potential dilution in earnings, the SFB’s asking rate appears expensive. At these valuations, analysts at Prabhudas Lilladher say the issue is fully valued, with little scope of return in the near term. “We recommend investors to subscribe to the issue with a long-term investment objective,” they add.

Risks

Concentration in Rajasthan (54 per cent of its AUM) is a key risk. Also, with 33 per cent exposure to term loans from banks, it is likely that after conversion into an SFB, the ability to tap the banking channels could be restricted due to regulatory constraints. And, if the SFB operations do not lead to the necessary cost benefits, particularly in establishing its deposit base, that could also impact its profitability.

)

)