Do you know your portfolio costs? If not, you probably are killing your returns. The investment costs, including fees, are one of the most overlooked aspects of investing. Ultimately the net returns that you make would be after deducting transaction costs, brokerage, management fees, carry (profit sharing in layman terms) and taxes.

Over the past few years, the financial services industry in India has been mirroring its Western counterparts by bringing in exotic products with hidden fees, high costs and inefficient tax structures. This phenomenon is not only restricted to equities, but also seen increasingly in fixed income investments.

After 2009, we have seen the Securities and Exchange Board of India (Sebi) implement a series of changes, to rationalise costs across the mutual fund industry, with a ban on entry load. Direct plans were introduced in 2013 and further in 2016, first year commission payouts were capped on equity mutual funds. These changes have reduced the overall incomes across the sector, thereby, spawning a plethora of repackaged offerings, with padded costs.

It will be interesting to note that financial services distribution has more muscle than the product manufacturer. A significant portion of these expenses are paid as trail fees. Let’s break this down.

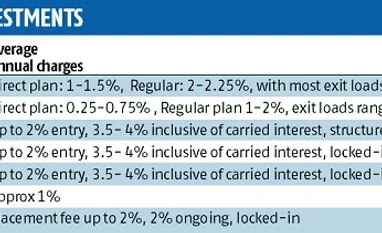

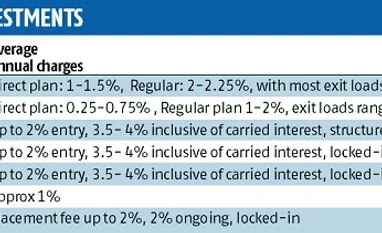

Mutual funds These are the ones that are easy to understand and can be identified by going through a few basic checks.

Take the case of costs in fixed income mutual funds. A few asset management companies practically run similar strategies across two sets of short tenor funds — one for corporate treasuries with low costs and high quality and the second for high networth individuals and retail with far higher costs and in most cases, with low quality.

Analysis of bond funds over the past 10 years show that bond funds yield 8-9 per cent (set to get lower, going forward) on a three- to-five-year basis. Most funds charge anywhere between 1 and 1.50 per cent per annum, which translates into almost one fifth of the overall return. Investors often are led to focus on the gross yields, while conveniently glossing over the investment costs. This has been masked to an extent, thanks to the capital gains accruing to bond funds, as a result of softening interest rates. An investor is perhaps better off seeking fixed income funds that are normally marketed to institutional investors, as this ensures, lower costs along with higher quality.

In equity funds, too, we find similar strategies managed by the fund manager, with significant difference in the expense ratios. It is clearly evident, why this is being done so.

Hidden costs Recent bull market in small- and mid-cap stocks have resulted in fee structures known as 2-20 (2 per cent annual fee and 20 per cent profit sharing) making a comeback. This is the norm amongst most portfolio management services (PMS) and alternate fund strategies. It’s surprising that investors do not question these cost structures. Intermediaries tend to push these as a result of higher payouts. In the bargain, simple equity funds with no hidden costs, are getting marginalised in a lot of portfolios.

By leaning on past returns, most investors do not focus on the overall fee structure, risks or exit costs. Significant money is being raised in mid-and-small-cap PMS schemes, alternative investment funds and structured products. For most investors, these are either locked in or exit will be at a steep load. To cover these costs, most strategies end up taking far higher relative risk.

Not understanding “profit sharing with catch up” and “profit sharing without catch up” will seriously impact your end returns. Once a fund manager delivers above a pre-defined return, he gets full share of the overall return, in a “with catch up clause”. An investor is perhaps better off in a fund that has a “without catch up” clause, wherein profits are shared only above the pre-defined return. Even if the scheme does deliver on expected lines, apart from the usual costs, clients pay up additionally as profit share, once certain thresholds are cleared. With such complexities, the end returns are known only on liquidation.

Structured notes are complicated instruments with possibly the most opaque fee structure. These are complex financial instruments with embedded derivatives. Apart from a set-up fee, investors are not privy to the inbuilt fees, as there is no transparency in overall structuring. A typical three-year structured note can have an overall fee as high as 5 per cent, paid for by the investor. Since the costs are not clearly understood, investors are in no position to bargain.

Opportunity costs While this is subjective and difficult to define, clients are usually subjected to opportunity costs usually by way of being locked into underperforming investments. With no window to exit, course correction is not possible. Often, inertia amongst investors result in underperforming investments, continuing in their portfolios.

While 1-2 per cent lower return may not sound much, they would ultimately bleed your portfolios year after year. Sample this: On an investment of ~10 lakh, a difference of 2 per cent compounding can impact end returns by as high as ~7 lakh in 10 years and, hold your breath, ~53 lakh in 20 years. Saving on costs can therefore meaningfully add to your wealth over a number of years.

A simple way to look at mitigating opportunity costs is being into open-ended investments with reasonable costs. High-quality open ended equity mutual funds fit the bill.

Who benefits? With hundreds of crores being raised in high-expense instruments, the distribution industry is the biggest beneficiary. Distribution of financial products, currently a lucrative opportunity, is probably one of the few areas where the manufacturer of products gets remunerated far lower than the distributor. After all, there is no free lunch. All these are directly or indirectly borne by clients. In the end, while client bears the full risk, investment managers and distributors and not clients reap investment rewards.

In India, investment management costs for investors are easily two-three times what is charged internationally. One may argue that, over time, returns are possibly higher in India. However, markets here are getting increasingly efficient resulting in relatively lower alpha compared to earlier years. Nowhere in the world, will you find similar expense ratios on both, equity and bond funds. Presently, some of the asset managers in India are indulging in this and getting away with it. Going forward, costs if not properly understood can shave off a meaningful share of the investor’s returns.

Spend some time on understanding costs versus anticipated returns before committing money for long term. The simpler the product, the lesser is the fee.

)

)