D-Mart IPO: You should book profits in Avenue Supermarts

Most analysts have arrived at a price target of Rs 600-660 over the next year and a half

)

Explore Business Standard

Associate Sponsors

Co-sponsor

Most analysts have arrived at a price target of Rs 600-660 over the next year and a half

)

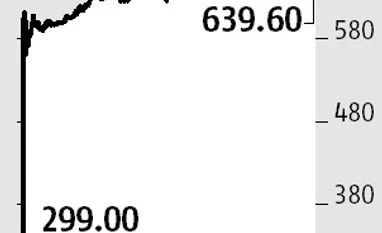

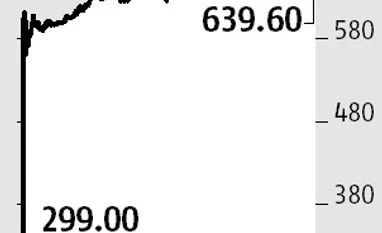

Given the doubling of the share price since listing on Tuesday, analysts say that investors should book profits and await better entry points (around the Rs 550 mark) in Avenue Supermarts, which runs a chain of retail stores under the D-Mart brand. Avenue Supermarts, which saw a gain of about 114 per cent to Rs 640 (IPO price Rs 299) on listing day, closed marginally lower at Rs 639. The key hurdle for investors is valuation.

At 77 times its annualised nine months FY17 earnings and about 60 times FY18 projections, the stock is clearly in the expensive zone. Amarjeet Maurya of Angel Broking believes that all the positive aspects such as return ratios, management strength, strategically located stores, low cost focus and strong brand are already factored in the current stock price. The brokerage recommends investors to book profit and doesn't expect multiples to re-rate due to stretched valuation.

Most analysts had arrived at a price target of Rs 600-Rs 660 over the next year and a half. Though analysts such as Amnish Aggarwal and Gaurav Jogani of Prabhudas Lilladher who have a price target of Rs 660 expect premium valuations to sustain given strong growth and limited options to play the organised retail story in India, the upside from these levels are clearly limited. According to an equity consultant, current valuations are not sustainable as a higher base of operations will make it difficult to maintain profit growth, which averaged 52 per cent in last four years. While some of the premium is justified given that the company, unlike others who are struggling, has succeeded in the food and grocery segment (which has high overheads and wafer thin margins), it will be difficult to scale up its current profitability metrics.

Says a retail analyst at a domestic brokerage, "Given its merchandise, which limits its gross margins to 15 per cent, and staff costs, operating profit margins are likely to be around 8 per cent mark going ahead." Despite the margin profile, the company commands valuations akin to those of FMCG companies. Moreover, unlike consumer companies, Avenue Supermarts as of now is not debt-free nor does it generate free cash flows. This, however, is expected to change in FY18 given that it will use part of the IPO funds to pay down debt (Rs 1,080 crore) and fit outs (Rs 370 crore). Thus, its earnings growth is expected to come from deleveraging (lower debt) and thus interest costs. Analysts have pegged the earnings growth for the company at 40 per cent, each for FY18 and FY19.

Given the seasonality, analysts say that investors should look at numbers for at least two to three quarters before taking a call on the stock. Says an analyst at a domestic brokerage who does not want to be identified, "It is difficult to sustain same store sales growth (SSG) in excess of 20 per cent year-on-year going ahead. The Street believes that the company will have SSG in high teens. For the stock to sustain valuations it has to keep SSG over the 20 per cent mark."

In addition to this, analyst highlight three other parameters that investors should look at. The first is the revenue growth number which should typically be above the 30 per cent mark, the second is on the gross margins of 14.5 per cent. Finally valuation calculations could go awry if the expansion targets over the next two to three years are not met.

Already subscribed? Log in

Subscribe to read the full story →

3 Months

₹300/Month

1 Year

₹225/Month

2 Years

₹162/Month

Renews automatically, cancel anytime

Over 30 premium stories daily, handpicked by our editors

News, Games, Cooking, Audio, Wirecutter & The Athletic

Digital replica of our daily newspaper — with options to read, save, and share

Insights on markets, finance, politics, tech, and more delivered to your inbox

In-depth market analysis & insights with access to The Smart Investor

Repository of articles and publications dating back to 1997

Uninterrupted reading experience with no advertisements

Access Business Standard across devices — mobile, tablet, or PC, via web or app

First Published: Mar 23 2017 | 8:58 AM IST