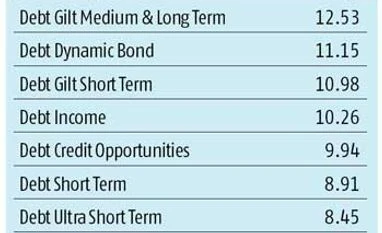

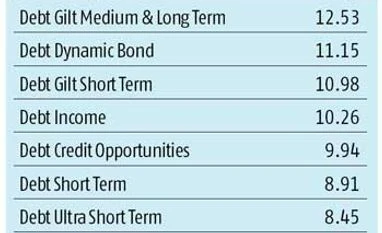

Debt emerges as better money maker than equity schemes

Against returns of less than 7 per cent from equities, debt funds made as high as 12 per cent

Chandan Kishore Kant Mumbai The past year has been one of debt mutual fund schemes, even as equity schemes struggled, with average category returns of under seven per cent.

On an average, the returns from debt-related schemes — short-term funds, dynamic bonds or credit opportunities fund — have stood anywhere between seven and as high as 13 per cent over the past year. It is worth noting that nearly 65 per cent of the total Rs 14 lakh crore of the MF sector’s assets are in the debt category.

With benign inflation, and a 75 basis points (bps) cut in interest rate by the Reserve Bank of India (RBI), debt schemes have benefited. Also, the 10-year yields slipped 50 bps boosting bond prices.

Murthy Nagarajan, head of fixed income at Quantum Mutual Fund, says, “Ten-year yields have moved down from 7.70 per cent to 7.20 per cent. Most of the debt funds had more than 10 year maturity and which allowed them to earn capital appreciation of three to four per cent and accrual income of eight per cent, a total return of 12 per cent.”

Sujoy Das, head of fixed income at Invesco MF, agrees. He says, "Capital gains were mostly due to a positive rate environment, led by RBI’s rate reduction cycle, its recent neutral liquidity stance and benign inflation environment.”

He expects the markets to remain buoyant. “This will be supported by lower fiscal, tax buoyancy, a normal monsoon and, in general, low inflationary pressures in global environment due to slowdown. The drop in energy prices and build-up of inventory is expected to support the benign inflation trajectory. RBI is expected to continue the accommodative stance and be mostly in line with the coordinated easy monetary policies of global central banks.”

With better monsoons, fund managers feel debt funds can perform better as there is expectation of another 50 bps rate cut.

“With good monsoons, food inflation is expected to come down, giving scope for RBI to cut rates by 50 basis points. This should take the 10-year yield below seven per cent, giving good capital appreciation to investors,” adds Nagarajan.

During the past one year, equity funds in the category of large-cap, multi-cap and mid-cap offered paltry returns of two to four per cent — lower than what a bank's saving account would have added. Steep correction in stock markets during January-February, followed by concerns arising out of the Brexit event took a toll on the markets. These had a cumulative impact on the performance of equity schemes.

)

)