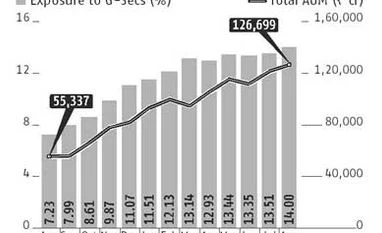

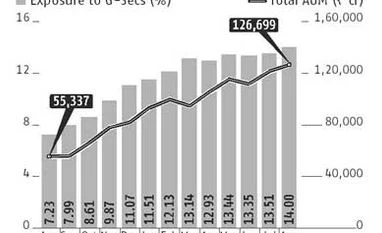

Debt MFs' double exposure in G-Secs to 14% on rate cut hopes

In last one year, allocation has nearly doubled to Rs 1.26 lakh crore

Chandan Kishore Kant Mumbai India’s debt mutual fund managers’ fancy with investment in government securities (G-secs) is continuing.

In the past one year, fund managers have doubled their exposure to G-secs through gilt funds. Their overall exposure in the asset category is 14 per cent, a level not seen earlier for years. About Rs 1.26 lakh crore of debt assets have found their way into G-secs. A year before, the amount pumped into this security was Rs 55,000 crore, show statistics from the Securities and Exchange of India.

A global drop in oil and commodity prices has raised expectation that interest rates and, thus, G-sec yields could be headed downwards for the long term. Recent inaction from the US Federal Reserve has further strengthened fund mangers' expectations on rate cuts.

Pankaj Murarka, head of equities at Axis Mutual Fund, says, “Over the next three quarters, we see a cut of 75 basis points in interest rates.”

Two months earlier, the fixed income market was expecting volatility because of the Greek situation and a potential rate increase by the US Federal Reserve. However, recent developments have settled these concerns.

According to S Naren, chief investment officer of ICICI Prudential MF, “We believe that towards the end of the year, there is a likelihood of an interest rate cut.”

The allocation towards gilts has been increased to benefit from the rate easing cycle of the Reserve Bank. Lower headline inflation and benign commodity prices create a case for further rate easing.

Most fund managers have been opting for longer duration debt paper, as these are likely to benefit the most from a reversal in the monetary policy stance. According to them, fixed income products with a three to five years duration will benefit the most. Nearly 95 per cent or Rs 1.2 lakh crore of the allocation in government paper is in securities with maturity of a year or above.

“We believe that duration funds might prove an attractive investment over the next one year. The shorter term rates have already fallen and this could be an opportune time to invest in funds with a three-year and above maturity profile. Also, the yield curve is flat at the longer end of the curve; hence, the opportunity lies there,” adds Naren.

)

)