Deleveraging key to improving profits for JP Associates

This will help bring down interest cost and address concerns over a stretched balance sheet

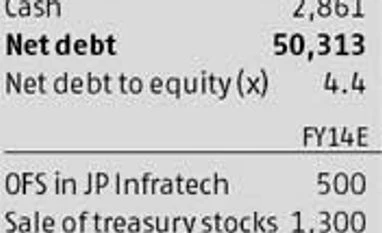

Jitendra Kumar Gupta Mumbai Jaiprakash Associates (JPA) plans to deleverage its balance sheet by bringing down its consolidated net debt of Rs 50,313 crore by about Rs 6,000 crore in FY14. The company, a leading player in construction, power and cement, intends to achieve this by selling a part of its cement business, land, treasury assets and a stake in Jaypee Infratech through the offer for sale (OFS) route. The plan to have lower debt is likely to be a major positive for the stock, which has been an underperformer (down 25 per cent since December 2012) on the back of high debt concerns. Says Chirag Negandhi of Axis Capital, "Management's stated intent to reduce group debt (including Jaypee Infratech) by Rs 6,000 crore, if achieved, can be a catalyst in reducing the group debt overhang, thereby benefiting the stock."

The company has a highly leveraged balance sheet, with net debt to equity of 4.4 times. Because of high debt a large part of its cash and profits are used in servicing debt and interest costs. For instance, in FY12, on an operating profit of Rs 5,769 crore, the company paid interest cost of Rs 3,192 crore (up 58 per cent compared to FY11). A Rs 6,000-crore cut in debt could bring its debt to equity down and lead to some savings in interest cost. Besides, if overall interest rates come down it will add to profitability. Jaspreet Singh Arora, who tracks the company at Anand Rathi Shares and Stock Brokers, says for every 50-basis points cut in interest rates, its profits are expected to rise up to 12 per cent, given that a large chunk of its Rs 21,038-crore standalone debt is rupee-denominated. The saving is likely to significantly impact the company's earnings.

Monetising assets The biggest component of its debt reduction is likely to come from its cement business. The company is reportedly in talks to sell its 4.8 million-tonne cement plant in Gujarat. The market is expecting the cement business to fetch an enterprise value (EV) of about $140-150 a tonne, which will translate into a price of Rs 4,000 crore for the plant. The entire proceeds, if utilised to retire debt, would significantly reduce this burden. Investors reacted positively to these reports, pushing the stock 17 per cent over the past couple of weeks.

Importantly, analysts believe the Gujarat unit sale could positively rub off on its remaining cement capacity of around 30 million tonnes, since it is currently pegged at an EV of $110 a tonne. "We value the cement business for an estimated capacity of 34.8 million tonnes in FY14, based on $110 EV a tonne. The valuation is at a discount to the current multiple of large players, ACC ($120), Ambuja ($145) and UltraTech ($160), and to the present replacement cost ($120)," says Arora of Anand Rathi.

Jaypee Infratech

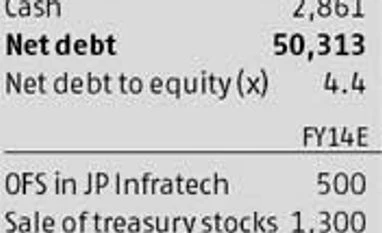

Apart from cement, the company is also looking to monetise its 83 per cent stake in Jaypee Infratech. According to Sebi regulation on minimum public shareholding requirements, JPA will need to bring down its stake by eight per cent to 75 per cent. At the current share price of Jaypee Infratech at Rs 39, sale of an eight per cent stake could mean proceeds of about Rs 500 crore for Jaiprakash Associates. This is marginal in the background of the large consolidated debt in the books but the company has more plans.

For instance, Jaypee Infratech alone has a net debt of Rs 6,568 crore, which it plans to bring down by about Rs 2,000 crore with the sale of land in Noida by March 2014. "Management said it is looking to sell 300 acres in the Greater Noida-I or II land parcel to raise Rs 2,000 crore (by FY14) to reduce debt and repay first tranche of loan due to IDBI in May 2015. We see this as a positive development," says Saurabh Mishra of Barclays. For the remaining debt in Jaypee Infratech, it has plans to refinance this at lower rates and extend the duration from 14 to 18 years, which effectively means lower cost and less pressure on cash flow.

)

)