Drop below 5,680 on Nifty would mean further downside

Devangshu Datta New Delhi The market saw a recovery in the past three sessions. The Nifty saw gains despite the RBI credit policy maintaining status quo. The next trigger is the US FOMC (Federal Open Markets Committee) meeting that starts today and concludes on Wednesday. The FOMC could give us a timeline on the tapering of the Quantitative Easing (QE) Programme. The market could therefore, see some sort of trending move on Thursday.

The intermediate trend is difficult to read. There have been falling tops with a 52-week high of 6,229, followed by a high of 6,125, and then a high of 6,011. There have also been lower lows of 5,910 in May, 5,857 in June and then 5,680, last week.

The trend would have to beat 6,011 to break the pattern of falling tops. On the downside, there's support at 5,800 and lower, at every 25-point interval. A drop below 5,680 would confirm that the downtrend continues. The 200-DMA is in the 5,800 zone, which reinforces support just below the current levels.

Short and medium-term Moving Average (MA) systems are still signalling sell. The Nifty is trading near its 10-Day MA, and below its 20-DMA and 7-DMA. This is a very volatile and choppy market so MAs signals are not very reliable.

Breadth remains worrying. The advance-declines ratio remain negative. The Junior and the CNX500 are underperforming the Nifty. The high-beta Bank Nifty is now testing resistance at about 12,000 and a breakout could pull the overall market up. A breakout above 12,050 could take the financial index till 12,250-12,300 immediately.

The dollar is trading very close to recent all-time highs versus the rupee. Weak trade numbers, coupled to other trends makes it quite likely that the dollar will gain some more. A weak rupee could mean counter-cyclical gains by IT stocks, which could provide a defensive hedge.

Domestic macro-economic data such as the IIP, the CPI and the WPI were much as expected, indicating a fall in inflation and a consolidation in manufacturing with perhaps, a slow recovery in GDP growth. The trade deficit widened. RBI's major consideration in not tinkering with interest rates or CRR would have been the need to defend the rupee. Apart from QE, market volatility could rise on political newsflow.

The Nifty's put-call ratio has edging into the bearish zone. The June PCR is at 0.94 while the three-month PCR is at 0.99. This could mean the market is braced for a fall. Open Interest clustered across the option chains suggests the bulk of expectations run between 6,200 on the upside, and 5,500 on the downside. That's a wide range of roughly 350-points in either direction.

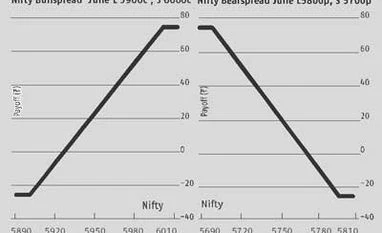

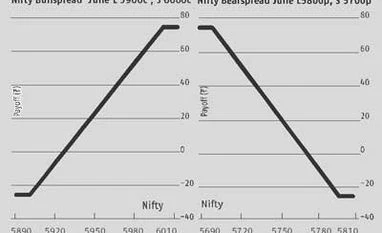

June could be a big swing month if a trend is established this week. Option spread risk:reward ratios are good near the money due to the expiry effect. A bullspread of long June 5,900c (44) and short 6,000c (18) costs 26 and pays a maximum 74. A bearspread of long 5,800p (49) and short 5,700p (22) has a similar risk:reward ratio with a cost of 27 and a maximum payout of three.

Given a Nifty spot value of 5,850, both these spreads could be struck. A trader looking for a two-way position can therefore, combine these two into a long strangle offset by a short strangle. This means taking a long 5,900c, long 5,800p offset with a short 6,000c and a short 5,700p. This combination costs 53 and pays 47 with breakevens at 5,747 and 5,953.

)

)