Beginning of an intermediate downtrend

Devangshu Datta New Delhi The market crashed on Monday, falling sharply on high volumes. Reportedly there was heavy institutional selling. The Nifty reacted from a recent high of 6,114 on Friday, which was technically a 52-week high. However, this was almost identical to the previous high of 6,111 in January and it could be read as a bearish double-top signal. The breadth was very negative. Not a single Nifty share gained on Monday and the broader market was also skewed almost 10:1 against rising shares.

This is almost certainly the beginning of an intermediate downtrend. The index has support at 5,975 and lower down, at 25-point intervals. If it is an intermediate downtrend, it should register lower highs and lower troughs for anywhere between two and 12 weeks. The short-term trend is also clearly negative. On the upside, there will be resistance at 25-point intervals with the first resistance at 6,025. The Nifty would need to cross 6,114 to confirm the long-term trend is positive.

The index bounced on April 10 from a low of 5,477. It hit 6,114. Given that move, Fibonacci retracements suggest potential supports at 5,875, 5,800 and 5,690. If the index drops below 5,700, it's likely to be a long-term bear market.The domestic macro-economic data wasn't too bad. Consumer inflation has fallen below 10 per cent, the index of industrial production was positive in March 2013, and the RBI has cut rates. But there is political instability.

Technically, moving average systems involving the 10 DMA and 20 DMA are still in buy mode. But the sheer drop on Monday and the negative nature of breadth outweighs lagging trend signals like MA crossover systems.

The Bank Nifty, which is very high-beta was the key driver for the rally. The financial index may now see some sort of sell off since its over-bought and also reacting to the Cobrapost sting. It has support at 12,200 and below that, at 12,050. IT could provide some sort of haven if the broader market does crack. The put-call ratios for the Nifty remain bullish, ranging above 1.25. Again, this could be a lagged signal that will take a while to catch up.

The next two or three weeks might well be downtrending. Options traders could continue to look for positions at some distance from money but even close to money spreads are offering reasonable return:risk ratios. The Nifty is at 5,985. Trader expectations suggest that the market is braced for a 200-250 point swing in either direction in the next five sessions. There's excellent open interest till around the 6,200c on the upside and on the downside there's good OI till 5,500p.

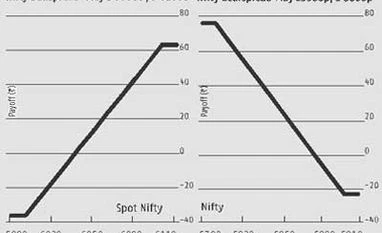

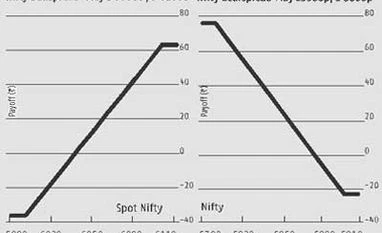

Risk:reward ratios are acceptable close to money and excellent one step away from the money. An on-the-money May bullspread of long 6,000c (80) and short 6,100c (42) costs 38 and pays a maximum 62. A May bearspread of long 5,900p (51) and short 5,800p (28) costs 23 and pays a maximum 77. An further from money long 6,100c (41) and short 6,200p (19) costs 22 and pays 78 while a long 5,800p (28) and short 5,700p(15) costs 13 and pays up to 87. Traders can therefore, take positions on the money or move further away. One can combine the on-the-money bearspread and bullspread for a set of long-short strangles. This entails taking a long 6,000c, long 5,900p offset with a short 6,100c and a short 5,800p. This combination costs 61 and pays a maximum of 39 with breakevens at 6,061 and 5,839. The ratio is adverse but the chances of a positive payoff is very high.

)

)