Short-term trend range bound between 5,925 & 6,020

The short-term trend seems positive or range-bound between 5,925 and 6,020, with minor congestion levels at 25-point intervals in this zone

Devangshu Datta New Delhi The market is range trading, with some upside momentum. Net institutional support has improved with continued foreign institutional investor (FII) buying. The Nifty is holding its ground above 5,925 but encountering resistance at 6,020. The Reserve Bank of India (RBI) mildly disappointed by making a minimum cut in the repurchase rate.

The short-term trend seems positive or range-bound between 5,925 and 6,020, with minor congestion levels at 25-point intervals in this zone. Breakouts in either direction could move it by about 100 points till 5,825 or 6,125. The intermediate trend is difficult to read and so is the long-term trend. We've seen a succession of higher highs since the index bounced on April 10 from a low of 5,477. However, the last high was 6,020 and if the trend cannot move beyond that level, it could reverse. The long-term trend is also questionable. The pullback above the 200-day moving average (DMA) suggests it is positive but it has to beat the 2013 high of 6,111 to confirm a continuing bull market. On the downside, the Nifty must stay above the 200-DMA at around 5,700, on the next downtrend.

RBI dashed the more optimistic expectations but it did cut rates, implying it is prepared to keep loosening. The full-year and fourth quarter results have been on the better side of, admittedly, low expectations. The domestic danger signals involve political instability with Parliament back in session and more scams coming to light.

Technically, moving average systems involving the 10-DMA and 20-DMA are now showing buy signals with the 10-DMA having climbed above the 20-DMA. Even the shorter-term trends seem positive, with the 7-DMA above the 10-DMA.

The Bank Nifty, which is very high-beta was the key driver of the rally till the rate cut. The financial index may now see some sort of sell-off since it is overbought. It has support at 12,200, and below that, at 12,050. Conversely, there is a little rally occurring in IT stocks and in beaten-down metal stocks, recovering from 52-week lows.

The put-call ratios for the Nifty are bullish now, ranging at above 1.25. May could still be a trending month, with a good chance of a five per cent swing. A breakout from the current range could well define the long-term trend. Options traders can continue to look for positions at some distance from money. The Nifty is at 5,970. Trader expectations suggest the market is braced for a 200-250 point swing in either direction in the next 5-10 sessions. There's excellent open interest till around the 6,200c and on the downside till 5,500p.

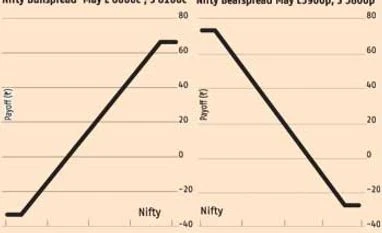

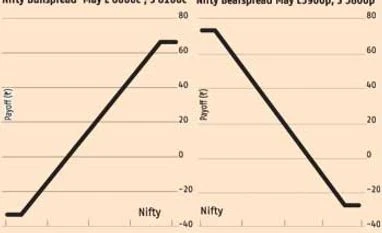

The risk:reward ratios are acceptable close to money and excellent one step away from the money. An on-the-money May bullspread of long 6,000c (73) and short 6,100c (36) costs 37 and pays a maximum 63. A May bearspread of long 5,900p (61) and short 5,800p (35) costs 26 and pays a maximum 74.

A further from money long 6,100c (36) and short 6,200p (16) costs 20 and pays 80 while a long 5,800p (35) and short 5,700p (19) costs 16 and pays up to 84. Traders can, therefore, take positions on the money or move further away. The nearest set of strangles with a positive payoff to risk ratio would be a combination of the long 6,100c, long 5,800p, offset with a short 6,200c and a short 5,700p. This combination costs 36 and pays a maximum of 64, with breakevens at 6,136 and 5,764.

)

)