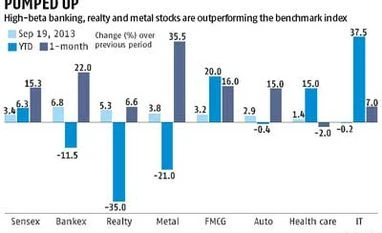

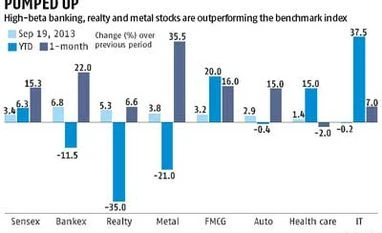

Emboldened, market marches towards risk

Investors shift from defensives like technology, health care, consumer goods to riskier sectors like banking, realty and metals

BS Reporter Mumbai A sharp up-move in the market has seen investors shift from defensives like technology, health care and consumer goods to riskier sectors like banking, realty and metals.

On a day when the market rallied 600 points on the back of a surprise US Fed move, stocks in the technology and pharmaceutical sector were seen underperforming while banking, realty, capital goods and metal stocks beat the benchmark Sensex by a wide margin. The BSE Bankex on Thursday rose by 6.7 per cent, realty was up 5.3 per cent, capital goods up 4.7 per cent and metals up 3.8 per cent.

Information technology (IT), which had gained nearly 38 per cent so far this year, was the only sector to register a fall.

Experts said investors were taking money off the so-called defensives, which had rallied substantially this year, to invest in high-beta names.

Analysts said the risk-on environment in the market was largely owing to the Fed's decision to leave its bond-buying programme untouched.

"Part of the rise in these (high-beta) stocks is because the market has already taken into consideration an improvement in the future performance of these stocks. While this was still uncertain till Tuesday, Wednesday's Fed announcement has boosted the outlook for these stocks," said Swapnil Pawar, chief investment officer, Karvy Capital.

Analysts said the market hoped an improvement in liquidity conditions and the stabilising rupee could lead to an improved financial performance.

Banking, realty and capital goods had taken a significant beating. Analysts said valuations at these levels were cheap and the stock prices had some catching up to do.

The banking sector, for instance, had seen a significant fall after the Reserve Bank of India tightened liquidity conditions. So far this year, the BSE Bankex has fallen by 12 per cent. On Thursday, the index was the best performing one and rose by 6.7 per cent, with YES Bank's 22 per cent rise leading the rally. Union Bank was the second-best performing stock and moved up 10 per cent.

However, analysts said the euphoria was unlikely to last long. Sector analysts said defensives could be back once the initial euphoria died. It would be a much more diversified sector performance.

The technology stocks have been riding the wave on the weak rupee.

"By the end of the year, we expect the rupee to be at Rs 65 to the dollar levels. The tailwind of weak rupee would be positive for this sector," said Jitendra Sriram, director and head of research, global research at HSBC Securities and Capital Markets. Apart from the rupee appreciation, a turn-around in the US economy would bode well for these companies.

)

)