Equity mutual funds add 4 mn accounts in 2015

Executives term these one of the best years as investors mature and quality of investment improves

Chandan Kishore Kant Mumbai Year 2015 has turned out to be a phenomenal one for India’s mutual fund sector. Its pure equity asset (diversified and equity-linked saving schemes or ELSS) has surpassed the Rs 4-lakh-crore mark — for the first time. Also, the inflows into equity schemes have continued for the 19th month in a row.

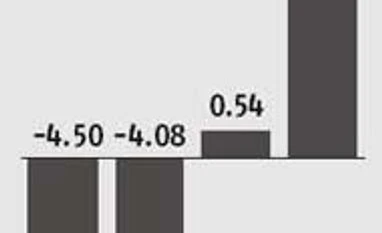

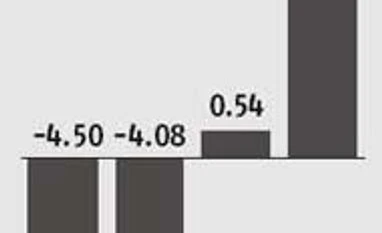

Since the 2007-08 world market collapse, the sector has lost a whopping 12 million equity investors' accounts. In 2015, mutual funds managed to add four million new equity folios in a span of 11 months. This happened in a year when key stock indices are down 15 per cent from their all-time highs and on an year-to-date basis, they are down seven per cent. What is more interesting is the fact that distributors' commission is capped at one per cent with effect from April 1, 2015. Despite this, there is no co-relation when it comes to new account opening.

A gush of fresh net investment to the tune of Rs 87,000 crore have found their way into schemes, which invest in stocks - yet again the highest ever for the sector in any year. Investor counts from smaller cities and towns have exceeded those of top 15 cities and the average size of systematic investment plan (SIP) is reaching Rs 4,000 per instalment.

Sundeep Sikka, chief executive of Reliance Mutual Fund, says, “This year has proved to be one of the best ever years for the sector. There has been a real comeback of retail investors who are not reacting to the market's steep volatility. Despite a weak and subdued market scenario, investors have continued to come to mutual funds through SIP.”

Compared with the earlier peak of 41.1 million equity accounts, the current numbers at 34.4 million is much lower. However, if the momentum continues unabated, it would not be a surprise to see equity investors’ base surpassing its earlier peaks.

“The quality of investments is superior than ever before. Investors are much mature than ever as they realise that at a time when physical assets like real estate and gold are not doing well for long, equity as an asset class can’t be avoided for long,” adds Sikka.

Industry as a whole has stepped up their campaigns to reach out to individual investors.

S Naren, chief investment officer of ICICI Prudential Mutual Fund, says, “We have been highlighting the underweight stance of Indian households in financial assets. Thankfully, this has made some progress in 2015. Making a small beginning, investors - big and small - have started investing in financial assets.”

According to Naren, a more meaningful shift will take place into financial assets going forward in 2016. "A large credit for this strategic shift in investor appetite for financial assets goes to underperformance of gold and real estate."

The barometer of gross sales in equity shows a significant improvement. During January-November, the mutual fund sector saw sales of equity schemes worth Rs 1.6 lakh crore. The only concern for the sector and its fund managers remains how to rationalise investors' expectations when it comes to returns. Against a 30 per cent return in 2014, the current year has proved to be dull year. However, investors have not yet reacted to it.

The real test for the sector will be when investors start reacting to poor returns.

“Markets are likely to be volatile and in such an environment. It is important to be able to maintain investors’ confidence because the general tendency of Indian investors is to pull out money when the markets are volatile, and to invest when the markets are high. This may not necessarily lead to the best investment experience,” says Naren.

)

)