FPIs' direct access could hit revenues of big brokerages

Sebi board on Friday allowed FPIs to trade directly in corporate bonds without going through a domestic broker

Shrimi Choudhary Mumbai The Securities and Exchange Board of India (Sebi)’s decision to allow foreign portfolio investors (FPIs) direct access in the debt segment has upset a large section of the brokering community as they fear the move may result in loss of revenues.

The Sebi board on Friday allowed FPIs to trade directly in corporate bonds without going through a domestic broker. The move gives FPIs an option to “directly access corporate bond market without brokers as has been allowed to domestic institutions such as banks, insurance companies, pension funds”.

While the move is aimed at deepening the corporate bond market, brokers fear a loss in revenues.

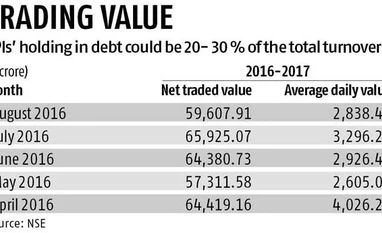

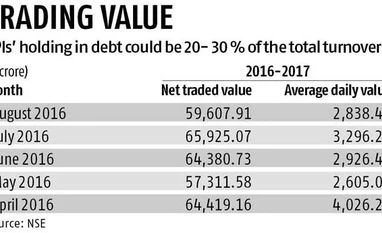

“Certainly there will be an impact. FPIs opting to go directly will make a dent on broker income. In debt segment, large and ultra large brokers are the ones who offered a lot of services like research, hand-holding and local intelligence to FPIs. The ratio of the debt segment is in the range of 20 to 30 per cent of the total business which could increase over a period of time,” said BSE Brokers Forum Vice-Chairman Alok Churiwala.

However, regulator have also clarified that FPIs can only do the trading for their own need and not on behalf of some others. “Access to over-the-counter (OTC), request for quote (RFQ) and electronic book provider (EBP) platforms of recognised stock exchanges will be provided to FPIs only for proprietary trading and participation of FPIs will help in deepening the corporate bond market,” said Sebi. The necessary amendments to the provisions of the Securities Contracts (Regulation) Rules, and (Foreign Portfolio Investor) Regulations, 2014, will be done accordingly.

“If you see investment in corporate bonds have increased in the recent past, the FPIs have used up nearly 66 per cent of their limit of $51 billion equivalent in Indian rupees so far. So, definitely to some extent it will have an impact which could hit the revenues of many brokers,” said Sabyasachi Mukherjee, AVP, wealth manager- IIFL.

The move to allow direct access first recommended in August by the H R Khan committee on development of corporate bonds. The Reserve Bank of India (RBI) acted on most of the recommendations and allowed FPIs direct access to government bond trading platforms, guidelines on which are being prepared. The central bank then had recommended Sebi allow FPIs direct access to trade in corporate bonds, without brokers.

On a relative basis, however, the number of brokers operating in the debt segment is far less compared to the equity segment.

“The bond market is largely a wholesale market as generally big institutions deal among themselves. The move may not impact majorly as only a few brokers operated in the debt segment,” said U R Bhatt, managing director, Dalton Capital.

)

)