He said he dreamt of one of the “fastest growing global corporations in the business of exchanges and the financial ecosystem”. Days later, Financial Technologies (FT) Group Chairman Jignesh Shah walked the talk by acquiring 60 per cent stake in Bourse Africa, a spot and derivatives multi-asset exchange.

Bourse Africa, Shah had said, would operate on a hub-and-spoke model, with Botswana as the hub, reaching out to 50 African nations. It was targeted to go live in 2009-10. The deadline has long been missed. All a group spokesperson says is an in-depth study of the market is still underway. “Only after the research is completed would Bourse Africa commence operations,” the spokesperson said in a reply to a detailed questionnaire.

It isn’t just his home ground where Shah, once the poster boy of the exchange business, is finding the going tough. His five global ventures, once seen by him as operating in bureaucracy-free markets and a hedge against the domestic business, are no longer safe bets.

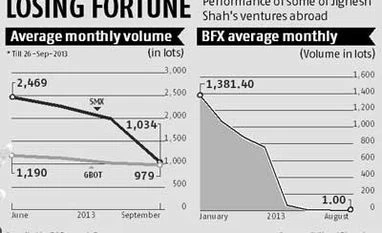

Consider the big-bang launch of the Singapore Mercantile Exchange (SMX) in August 2010. Shah had managed to hire Leo Melamed, former chairman of the Chicago Mercantile Exchange (CME), as chairman of its advisory committee. But Melamed resigned within a month, owing to a controversy on conflict of interest with CME, in which he was still a director. A string of resignations followed, with Shah having to shed his initial obsession with hiring global names and having to appoint an FT Group candidate as SMX chief executive. In the last few months, the exchange has seen a sharp fall in volumes, following the National Spot Exchange Ltd (NSEL) crisis.

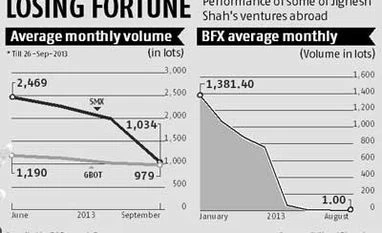

Trading volumes on the Manama-based Bahrain Financial Exchange (BFX) have almost been wiped out. FT had received regulatory nod from the Central Bank of Bahrain to launch BFX, touted the first exchange in West Asia to offer a platform to trade in equities, commodities, bonds, currencies, Islamic financial instruments or Sharia-compliant products.

While the NSEL crisis broke out in July, Shah’s problems had started in April, when the Reserve Bank of India issued a circular asking Indian companies investing abroad under the direct investment route to secure its permission to launch products/services based on the Indian currency. This took a toll of one of the most successful rupee/dollar futures on BFX. In April, 762 lots were traded on BFX, before these were almost phased out. Another of Shah’s foreign exchanges, the Global Board of Trade (GBoT), based in Mauritius, saw a 20 per cent fall in volumes during the same period.

However, the biggest disappointment was the Dubai Gold and Commodities Exchange (DGCX), in which Shah had initially tasted success. DGCX, launched in partnership with the Dubai government, saw the FT Group’s stake fall from 44 per cent to 30.95 per cent, owing to its failure to subscribe to a rights issue last month. An FT spokespersons explained this saying, “It wasn’t possible to obtain regulatory approval within 10 days.”

There were other setbacks, too. The majority partner, Dubai Multi Commodities Centre (DMCC), replaced the FT Group-supplied trading and clearing technology with a new system, the EOS, supplied by Cinnober. DMCC also launched futures trading in FT Group’s rival, the BSE benchmark S&P Sensex.

For the FT Group, the significance of DGCX is the volumes of the exchange have been rising through the last year. According to information on the DGCX website, volumes have jumped 80 per cent in terms of the lots traded.

After the NSEL controversy broke out, DGCX distanced itself from the FT Group, saying FT was a minority shareholder in DGCX, and no director of the exchange had any operational responsibility for the running of FT. Earlier, it was reported the FT Group was scouting for buyers for its stake in DGCX.

The FT Group spokesperson said he couldn’t comment on market speculation. He adds, “On an average, exchanges all over the world take five-seven years after the commencement of operations to stabilise and bring in liquidity. A case in point is DGCX, which took seven years to become what it is today. Indian exchanges, too, take similar periods to bring in liquidity and many exchanges in various asset classes are yet to record the desired volume and liquidity. Moreover, as these ventures are two-three years old in production, they would take some time to stabilise.”

“All foreign exchanges are run professionally by their respective management teams, under the regulatory supervision of varied world-class regulators, subject to different market conditions,” he said.

)

)