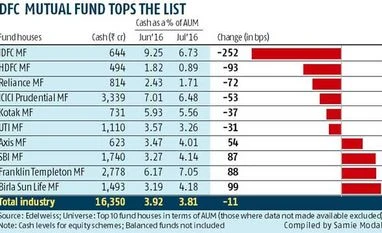

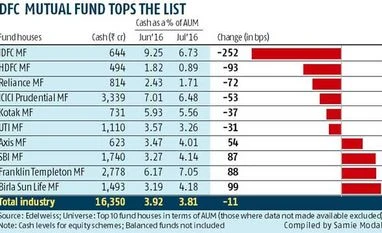

Fund managers deploy cash in stocks rally

Fund houses like IDFC MF, HDFC MF and Reliance MF were aggressively dipping into their cash reserves to increase exposure to stocks

Samie Modak Mumbai Cash with equity mutual funds (MFs) dipped in July, amid a rally in the stock markets. Cash levels for the segment dipped by 11 basis points (bps) to 3.81 per cent of all assets under management (AUM). On the BSE, the benchmark Sensex had rallied nearly four per cent in July, while the BSE Midcap index gained eight per cent.

Fund houses like IDFC MF, HDFC MF and Reliance MF were aggressively dipping into their cash reserves to increase exposure to stocks. Their cash levels fell between 72 bps and 252 bps. The decline indicates fund managers expect the markets to continue to do well.

Meanwhile, cash levels at SBI MF, Franklin Templeton MF and Birla Sun Life MF increased, either due to profit-taking or a cautious approach towards fresh investments. As a result of the mixed approach, the net investments of MFs in the stock markets remained flat. The total cash available with equity MFs was at Rs 16,350 crore, about 3.81 per cent of the total AUM.

)

)