FUND PICK: Religare Invesco Credit Opportunities Fund

Better credit profile, higher returns

BS ReporterReligare Invesco Credit Opportunities Fund, classified under the ultra-short-term debt fund category, has consistently featured in the top 10 percentile (CRISIL Fund Rank 1) over the past eight quarters. Managed by Nitish Sikand, the quarterly average assets under management (AUM) of the fund stood at Rs 2,376 crore on June 30.

The fund's objective is to generate high level of current income (vis-a-vis treasury bills) consistent with preservation of capital and maintenance of liquidity by investing primarily in investment grade debt securities and money market instruments.

Ultra short-term debt funds typically invest in short-term securities - up to one year. Their portfolio largely comprises short-term corporate debt papers, certificates of deposit (CDs), commercial papers (CPs) and treasury bills among other money market instruments. Compared with income and short-term income funds, these funds maintain portfolios that are more liquid and less interest rate-sensitive.

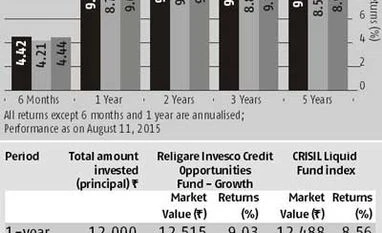

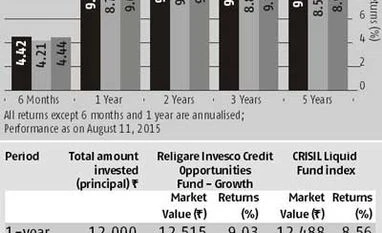

Superior performance The fund has outperformed its benchmark (CRISIL Liquid Fund Index) and the category (schemes defined under CRISIL Mutual Fund Ranking - Ultra Short-Term Debt Fund Category) across time frames (see chart). An investment of Rs 1,000 in the fund at its inception would have grown to Rs 1,643 (8.70 per cent CAGR) by August 11, 2015, compared with Rs 1,559 (7.75 per cent CAGR) for investment in the benchmark and Rs 1,605 (8.29 per cent CAGR) for investment in the category. The fund has also outperformed in systematic investment plan (SIP) returns vis-à-vis its benchmark across all time frames

Portfolio analysis Over the past year, the fund has maintained an average exposure of around 87 per cent to CPs versus its peers' 29 per cent. The fund maintained considerably lower exposure (3.16 per cent) to CDs compared with the category (36 per cent) over the same period.

In terms of the credit profile, the fund has maintained a major portion of its assets in highest rated papers (AAA/P1+). In the year ended June 2015, 86 per cent of its portfolio, on an average, has been invested in the highest rated papers compared with the category's 72 per cent.

The fund's average maturity varied from 25 days to 44 days in the past year, compared with its peers' average maturity ranging from 126 days to 246 days. Low average maturity reduces the fund's interest rate risk. CRISIL Research

)

)