As a step to broad-base its revenue streams, General Insurance Corporation (GIC Re), the government-owned general reinsurer which has filed a draft red herring prospectus with the Securities and Exchange Board of India (Sebi) for a public issue, plans to increase its income from health insurance, property and life insurance segments.

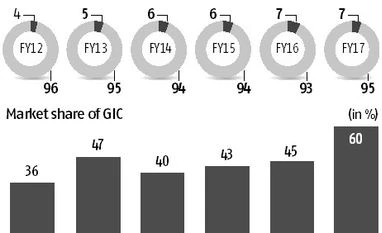

Currently, 95 per cent of the GIC’s premium income comes from the non-life insurance segment. With non-life premiums seeing a sharp jump in the year ended March 2017, GIC Re registered an 82 per cent growth in income to Rs 33,741 crore from Rs 18,534 crore in 2015-16.

Elaborating on its business strategy, GIC Re said in the prospectus that the company had intentions to build overseas fire (property), space and cyber security businesses in the coming years. GIC’s reinsurance written outside India constitutes 30.53 per cent of its total business in FY 17. Now, the company is looking to expand its presence in select overseas geographies and markets to continue its growth in reinsurance business.

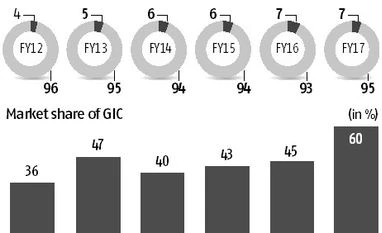

Besides broad-basing revenue streams, the state-owned reinsurer also has to worry about the competition from foreign players who have been allowed to operate in the country. GIC has accounted for 60 per cent of the premiums ceded by Indian insurers to reinsurers.

Till 2016, GIC was the sole reinsurer for the Indian market. But, after the insurance regulator permitted the entry of eight foreign reinsurers like Swiss Re, Munich Re and Lloyds to operate in India, the size of the Indian reinsurance market was estimated at Rs 38, 800 crore in FY17.

Sources: CRISIL Report and Draft Prospectus

According to CRISIL research, reinsurance premiums in India are projected to increase at 11-14 per cent CAGR (compound annual growth rate) over the next five financial years to touch Rs 70, 000 crore by FY22.

GIC has always enjoyed the first preference to participate in the reinsurance business from Indian reinsurers. However, the insurance sector regulator, Insurance Regulatory and Development Authority of India, has said private and foreign reinsurers have been accorded the same preference as GIC. This will adversely affect GIC’s business and its financial condition.

While the public listing would increase the company's visibility, it would also bring into sharp focus the issues of corporate governance and the role of government in business decision-making.

Ashvin Parekh, managing partner at Ashvin Parekh Advisory Services LLP, said listing would give a push to strengthening governance at the company.

While there were internationally listed reinsurers like Swiss Re and Munich Re, there would not be a benchmark available in India as no reinsurer was listed on domestic bourses, he said.

)

)