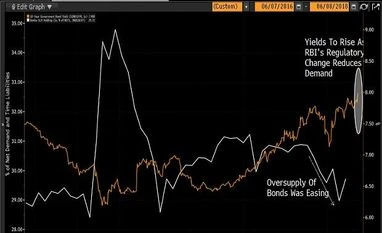

The prevailing environment of rising bond yields, in part due to RBI’s hawkish policy bias, has made banks unwilling to hold government bonds in excess of their liquidity requirements. This is because banks fear capital losses, which now need to be marked to market. Previously, banks were not required to mark to market a part of their excess holdings of government bonds, and public-sector banks typically held this excess to support bond yields.

Given that public sector banks are already reeling under stress from a cleanup of bad loans in the banking system, their appetite for booking treasury losses has aptly disappeared. The fact that the RBI has allowed banks to spread their capital losses on bond holdings over the next four quarters is unlikely to help much.

)