Higher redemption hits inflow in equity MFs

According to the Association of Mutual Funds in India, about 60% of all equity assets stay invested for less than two years

Chandan Kishore Kant Mumbai The assets under management of equity mutual funds are rising, new account opening is up month-on-month and sale of equity funds are at new highs.

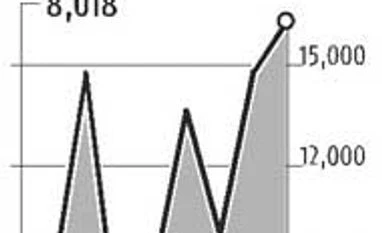

However, amid this, a set of investors are redeeming their units at a faster pace, taking a toll on inflow into the equity segment. In the first half (April-September) of 2016-17, collective gross redemption was Rs 69,879 crore, a rise of 90 per cent over the Rs 36,978 crore in the same period last year. So, the average monthly redemption is Rs 11,650 crore thus far in FY17 against Rs 7,600 crore in FY16.

This trend has impacted net inflow in equity to a paltry sum of Rs 22,233 crore in the first half, from a robust net Rs 53,666 crore in the corresponding period last year. So, despite the substantial rise in sale of equity products, fund managers continue to get substantial requests for redemptions, too.

“It is not easy to quantify who these investors are. Certainly not those who came through systematic investment plans. That’s sticky money and does not go in a flash. Such redemptions are made by those who came early, through lumpsum investments. In the past few months, lumpsum investments have taken a pause,” says the chief executive of a fund.

According to the Association of Mutual Funds in India, about 60 per cent of all equity assets stay invested for less than two years. Suggesting that more than half of equity assets tend to move out from MF schemes within two years, a rising concern.

Higher redemptions have hit overall inflow into equity. Having had quite a volatile year, with a weak start at the beginning of 2016, these have reduced by more than half. Further, the sector is less likely to see similar robust inflow into equity this year as it had seen over the past two financial years, with an average flow of Rs 72,000 crore.

)

)