HNIs unwind before year-end

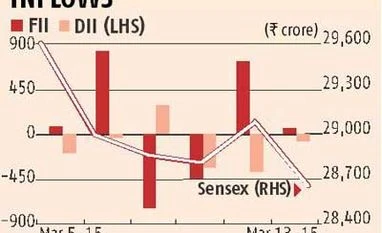

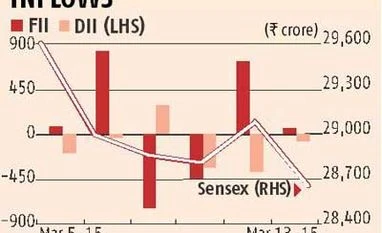

Joydeep GhoshSachin P MampattaDespite two very positive news for the markets - a rate cut by the Reserve Bank of India and passage of the much-awaited insurance Bill - the Sensex lost 945 points or 3.2 per cent during the week. Market players say the sell orders came mostly from high networth individuals (HNI) who had borrowed long-term money at the start of the financial year to play the rising market. "Lenders give these loans at 12 to 15 per cent to HNIs for the entire financial year. The borrowing was quite high this year because of election expectations. With the year coming to an end, HNIs are unwinding positions to repay borrowers. Anyway, they are sitting on good profits," said a broker. According to BSE data, foreign institutional investors were net buyers of Rs 525 crore for the week while domestic institutional investors were net sellers of Rs 730 crore.

Joydeep Ghosh

Sebi hiring again The Securities and Exchange Board of India (Sebi) is on hiring mode once again, albeit in limited numbers. After a gap of a year, Sebi is hiring Grade-A officers on a full-time basis. It had gone through a similar recruitment exercise in 2013, when it was looking to hire 75 officials. This time it is only to increase the regulator's information technology resources and the number of recruitments will only be four. The salary isn't bad though. Candidates are offered a cost to company of Rs 12.13 lakh.

Sachin P Mampatta

Sharekhan deal soon? The deal to acquire private brokerage Sharekhan seems to be in its final stages. Industry sources said senior officials of Warburg Pincus are expected in India next week to do the final due diligence. Reports suggest others like Actis and IndusInd Bank are also in the race to buy it. Citi Venture Capital international bought 85 per cent of the company in 2007 from various stakeholders for Rs 800 crore. Analysts say the company is now being valued at around Rs 3,000 crore.

Joydeep Ghosh

)

)